Get Irs Td F 90-22.1 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS TD F 90-22.1 online

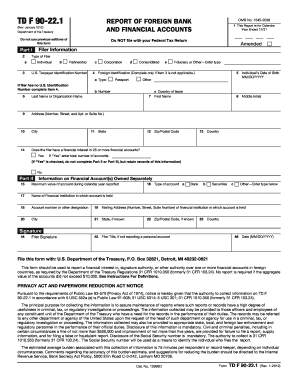

Filing the IRS TD F 90-22.1, also known as the Report of Foreign Bank and Financial Accounts (FBAR), is essential for U.S. persons with foreign financial interests. This guide offers a clear and structured approach to complete the form online, ensuring compliance with the requirements set by the Department of the Treasury.

Follow the steps to successfully complete and submit your FBAR online.

- Click ‘Get Form’ button to obtain the TD F 90-22.1 form and open it in the editor.

- Enter the calendar year for which you are reporting in item 1. This is crucial as it identifies the period of interest.

- Select the type of filer by checking the appropriate box in item 2. This includes individual, partnership, corporation, and other definitions.

- Provide your U.S. taxpayer identification number in item 3. If you do not have one, complete item 4 instead.

- Fill in your personal details such as name, date of birth, and address in items 5 through 13, depending on your residence.

- In item 14, indicate if you have a financial interest in 25 or more financial accounts and provide the total number if applicable.

- For reporting financial accounts owned separately, complete Part II by providing details such as maximum account value, account type, and financial institution information.

- If reporting joint accounts, move to Part III and enter similar details, ensuring to include the principal joint owner's information.

- For accounts where you have signature authority without financial interest, fill out Part IV, providing necessary details about the accounts.

- If filing a consolidated report, complete Part V with details about each account owned by the entities included.

- Review all entered information for accuracy and completeness to avoid any potential penalties for missing or incorrect information.

- Finally, save your changes, download or print the form, and ensure you submit it to the Department of the Treasury at the specified address.

Start filling out your IRS TD F 90-22.1 online today to ensure compliance with reporting requirements.

When you are preparing to file IRS TD F 90-22.1, you'll need specific documents, including the account number, bank name, and the maximum account balance during the year. It is also helpful to have personal identification information and a record of any associated accounts. Gathering these documents beforehand can streamline your filing process. Using uslegalforms can assist in organizing your paperwork.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.