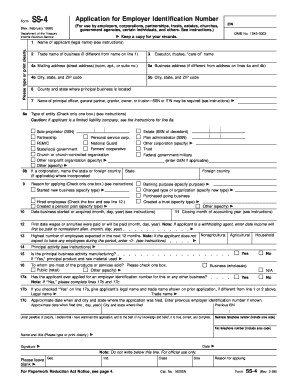

Get Irs Ss-4 1998

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS SS-4 online

How to fill out and sign IRS SS-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Verifying your earnings and presenting all essential tax documents, including IRS SS-4, is a responsibility unique to US citizens.

US Legal Forms makes your tax management more efficient and precise.

Store your IRS SS-4 securely. You must ensure that all your relevant documents and records are organized while keeping in mind the deadlines and tax laws established by the IRS. Simplify the process with US Legal Forms!

- Obtain IRS SS-4 in your browser from your device.

- Access the fillable PDF file with a single click.

- Commence completing the online template field by field, adhering to the prompts of the advanced PDF editor's interface.

- Accurately enter text and figures.

- Select the Date field to automatically set the current date or modify it manually.

- Utilize Signature Wizard to create your unique e-signature and sign in just minutes.

- Consult the IRS guidelines if you still have any questions.

- Click Done to preserve the changes.

- Proceed to print the document, download, or share it via email, text message, fax, or USPS without leaving your browser.

How to modify Get IRS SS-4 1998: personalize forms online

Place the appropriate document management resources at your command. Complete Get IRS SS-4 1998 with our reliable service that features editing and eSignature options.

If you desire to finalize and authenticate Get IRS SS-4 1998 online effortlessly, then our web-based solution is your best choice. We provide a rich library of template-based documents that you can adjust and finish online. Additionally, you don't need to print the document or rely on external services to make it fillable. All essential tools will be readily accessible as soon as you access the document in the editor.

Let’s explore our online editing tools and their primary features. The editor presents an intuitive interface, so you won't spend much time learning how to use it. We’ll look at three key areas that allow you to:

In addition to the aforementioned capabilities, you can protect your document with a password, apply a watermark, convert the document to the required format, and much more.

Our editor simplifies modifying and certifying the Get IRS SS-4 1998 significantly. It enables you to handle virtually everything related to form management. Furthermore, we consistently ensure that your file editing experience is secure and adheres to essential regulatory standards. All these factors enhance the enjoyment of using our tool.

Obtain Get IRS SS-4 1998, implement the required modifications and alterations, and receive it in your desired file format. Try it out today!

- Alter and comment on the template

- The upper toolbar offers tools that assist you in highlighting and obscuring text, excluding graphics and images (lines, arrows and checkmarks, etc.), signing, initialing, dating the document, and more.

- Arrange your documents

- Utilize the left toolbar if you want to rearrange the document or/and remove pages.

- Get them ready for distribution

- If you wish to make the template fillable for others and distribute it, you can apply the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

To file a W-4V with Social Security, complete the form accurately with your necessary personal information. Submit it directly to your local Social Security office to ensure proper processing of your tax withholding requests. Using a platform like USLegalForms can guide you through the filing process smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.