Get Irs Publication 4681 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Publication 4681 online

How to fill out and sign IRS Publication 4681 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren’t linked to document management and legal procedures, completing IRS forms can be rather stressful.

We recognize the significance of accurately finishing documents. Our online application offers the answer to simplify the process of completing IRS forms as straightforward as possible.

Using our comprehensive solution will enable efficient completion of IRS Publication 4681. We will handle everything for your ease and simplicity.

- Click the button Get Form to access it and begin making changes.

- Complete all necessary fields in your document with our user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the entered information.

- Include the date of submitting IRS Publication 4681. Utilize the Sign Tool to create your unique signature for the document verification.

- Finish editing by clicking Done.

- Send this form directly to the IRS in the most convenient manner for you: via email, using online fax, or postal mail.

- You have the opportunity to print it on paper when a physical copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS Publication 4681 2018: personalize forms online

Simplify your document preparation process and tailor it to your needs with just a few clicks. Complete and endorse Get IRS Publication 4681 2018 using a powerful yet user-friendly online editor.

Creating documentation is often challenging, particularly when you do it infrequently. It requires you to strictly follow all procedures and thoroughly fill in all fields with complete and accurate details. Nevertheless, it frequently occurs that you need to modify the document or add extra fields to complete. If you wish to enhance Get IRS Publication 4681 2018 before submitting it, the most effective method is utilizing our all-encompassing yet straightforward online editing tools.

This comprehensive PDF editing tool allows you to swiftly and effortlessly complete legal documents from any device connected to the internet, implement essential modifications to the template, and add additional fillable fields. The service allows you to designate a specific area for each type of data, such as Name, Signature, Currency, and SSN, etc. You can set them as mandatory or conditional and assign responsibility for each field to specific individuals.

Our editor is a flexible multi-functional online solution that can facilitate you in easily and swiftly optimizing Get IRS Publication 4681 2018 and other forms to meet your requirements. Reduce document preparation and submission time while ensuring your forms appear flawless without any difficulties.

- Access the required file from the catalog.

- Fill in the blanks with Text and insert Check and Cross tools into the tickboxes.

- Utilize the right-hand toolbar to modify the template with new fillable sections.

- Select the fields based on the type of information you wish to be gathered.

- Designate these fields as mandatory, optional, or conditional and arrange their sequence.

- Assign each section to a specific individual using the Add Signer feature.

- Ensure that you have completed all necessary adjustments and click Done.

Get form

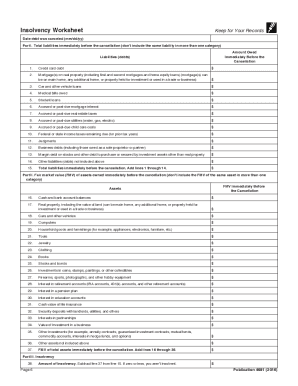

IRS Form 4681 does not exist as a standalone document; instead, it refers to the guidelines and information provided in IRS Publication 4681 regarding canceled debts. This publication serves as a comprehensive resource for understanding how to handle forgiven debts in your taxes. Familiarizing yourself with the material is crucial for correct tax reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.