Get Irs Instructions For Employee Copies Of W-2 Forms 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS instructions for employee copies of W-2 forms online

This guide provides users with a clear and supportive overview of how to effectively fill out the IRS instructions for employee copies of W-2 forms online. Whether you are seasoned in tax filing or new to the process, this step-by-step approach will assist you in understanding each component of the form.

Follow the steps to complete the IRS instructions for employee copies of W-2 forms online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

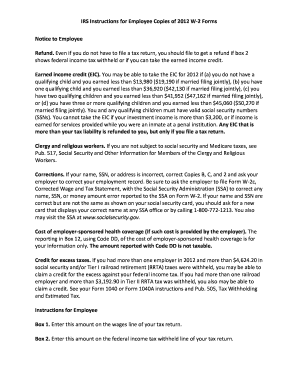

- Read the notice to employee, which explains important aspects such as refunds and the earned income credit. Ensure that you understand the eligibility criteria for potential tax benefits.

- Review the instructions for correcting any errors, such as name or Social Security number discrepancies, and know how to request corrections from your employer.

- Fill in the necessary boxes with accurate information. For instance, ensure box 1 reflects your total wages as required, and box 2 shows the total federal income tax withheld. Verify each section as you proceed.

- If applicable, complete any additional sections relevant to your situation, such as allocated tips reported in box 8 or dependent care benefits in box 10.

- Consult the codes listed in box 12 as they may pertain to retirement plan contributions, health coverage costs, or other important tax elements necessary for accurate reporting.

- Make sure to review box 13, which indicates whether special limits may apply to your traditional IRA contributions based on your retirement plan status.

- Once all fields are completed accurately, you may save the changes, download, print, or share the form as needed.

Start filling out your IRS instructions for employee copies of W-2 forms online today!

Get form

To obtain your W-2 transcript from the IRS, you can request it online through the IRS website or by calling their helpline. You may need to provide specific information to verify your identity, as detailed in the IRS Instructions for Employee Copies of W-2 Forms. Using resources like uslegalforms can streamline this process and ensure you follow the correct steps to get your transcript efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.