Loading

Get Irs Instructions 1041 - Schedule K-1 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1041 - Schedule K-1 online

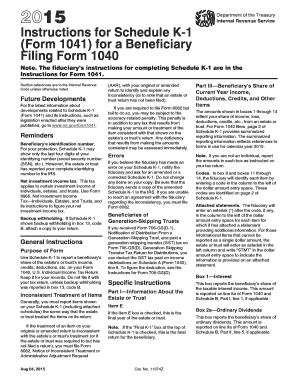

Completing the IRS Instructions 1041 - Schedule K-1 online can greatly simplify the process of reporting income, deductions, and credits received as a beneficiary of an estate or trust. This guide will walk you through each section and field of the form, offering step-by-step instructions to ensure accuracy and compliance.

Follow the steps to effectively complete Schedule K-1 online.

- Click ‘Get Form’ button to obtain the Schedule K-1 form and open it in the editor.

- Begin by filling out Part I, which requires information about the estate or trust. Include the name, address, and identification number of the trust or estate.

- In Part II, you must provide your information as the beneficiary. This includes your name, address, and identifying number. Ensure accuracy to avoid issues with the IRS.

- Navigate to Part III, where you will detail your share of the estate’s or trust’s income, deductions, credits, and other pertinent items. Pay close attention to each box — each should be filled out based on the allocations provided by the fiduciary.

- Ensure that you report items according to how they were reported on the estate’s or trust’s return. If discrepancies arise, you may need to file Form 8082.

- If applicable, attach any statements that may provide additional information regarding specific items, especially for codes and amounts that exceed a single dollar entry.

- For items in boxes 13 and 14, carefully follow the provided instructions to determine how to report credits and other important information on your personal tax return.

- Once all fields are correctly filled, you can save changes, download, print, or share your completed Schedule K-1 as required.

Complete your IRS documents online efficiently and accurately by following this guide.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

1 form is prepared by the estate or trust’s fiduciary, which can be a personal representative or trustee. They are responsible for reporting each beneficiary's share of income, deductions, and credits. To ensure accuracy, it's advisable to follow the IRS Instructions 1041 Schedule K1 closely when preparing this form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.