Get Az Ador 11263 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ ADOR 11263 online

Filling out the AZ ADOR 11263 form online is a straightforward process that can greatly streamline your tax reporting obligations. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out your AZ ADOR 11263 form online

- Click ‘Get Form’ button to obtain the form and open it for filling.

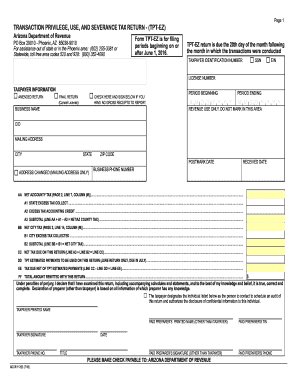

- Begin by entering your taxpayer identification number. You can select either your Social Security Number (SSN) or Employer Identification Number (EIN) as appropriate.

- Next, fill in your license number and select the relevant taxpayer information options, such as whether this is an amended return or a final return.

- Provide your business name and address, ensuring that you include the city, state, and zip code. If there is a change in your mailing address, mark the designated box.

- Indicate the period for which you are filing by completing the 'Period Ending' and 'Period Beginning' date fields.

- Proceed to complete the revenue calculations, starting with the net Arizona/county tax. Enter amounts in the provided yellow fields that will auto-calculate based on your entries.

- Fill in all sections regarding city tax, ensuring accuracy in calculations of gross receipts and taxes due.

- Review all entered information for accuracy before proceeding. Make use of the 'Calculate' button as needed to ensure all values are correct.

- Complete the declaration section, making sure to print or e-sign where indicated. Don't forget to designate a contact person if necessary.

- Finally, save your changes, download, print, or share the form as needed using the available options.

Complete your AZ ADOR 11263 form online today for a seamless tax experience.

The Arizona Department of Revenue (AZ ADOR) administers tax laws and ensures compliance with state tax regulations. They handle everything from tax collection to providing resources for taxpayers. Understanding their role is critical for ensuring that you meet your obligations, particularly under the AZ ADOR 11263 guidelines. The US Legal Forms platform can offer valuable information and support for navigating your interactions with the department.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.