Get Irs Instructions 1040 Schedule C 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1040 Schedule C online

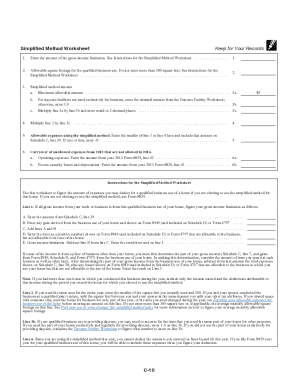

Filing your taxes as a sole proprietor can be simplified by using IRS Schedule C (Form 1040) to report your business income and expenses. This guide will walk you through the process of completing Schedule C online, ensuring you understand each section and can accurately report your financial information.

Follow the steps to complete Schedule C online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and Social Security Number (SSN) at the top of the form. If you have an Employer Identification Number (EIN), input that on the designated line.

- In line A, provide a brief description of your business or professional activity.

- In line B, enter the six-digit code from the provided Principal Business or Professional Activity Codes chart that best describes your business.

- Enter your business address in line E, providing the full street address and any suite or room number.

- Check the method of accounting you use in line F: cash or accrual. Ensure this method clearly reflects your income.

- Answer question G regarding material participation in your business. This is important for determining if your business activity is passive.

- If you started or acquired this business in the current tax year, check the box on line H.

- For payments requiring Form 1099, check ‘Yes’ on line I; otherwise, check ‘No’.

- Complete Part I by entering your income amounts in line 1 and any adjustments for returns and allowances in line 2.

- Proceed to Part II to detail your business expenses, entering each type of expense in each relevant line provided.

- After completing all required sections, review your information for accuracy before saving.

- Once satisfied, you can save changes, download a copy, print the form, or share it as needed.

Start filling out your IRS Schedule C online today to ensure you accurately report your business income and expenses!

Get form

To find your company's business code, refer to the IRS Instructions 1040 Schedule C, which provides a list of all applicable codes. You may also use reports from relevant business organizations or consult tax professionals who can assist you. Platforms like US Legal Forms simplify this search and ensure you choose the correct code for accurate filings.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.