Loading

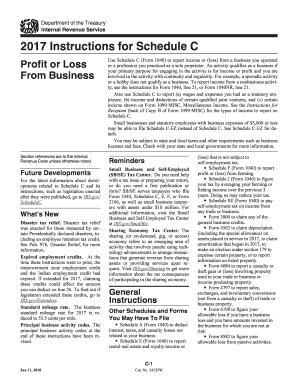

Get Irs Instructions 1040 Schedule C 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1040 Schedule C online

Filing your Schedule C (Form 1040) can be straightforward when guided through each section accurately. This document provides a step-by-step approach to help you report income or loss from your business effectively.

Follow the steps to complete your IRS Schedule C online smoothly.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Provide your legal name and address in the designated fields. Ensure that the name matches the one reported on your Form 1040.

- Enter your business name (if different from your personal name) in the appropriate section.

- Fill out Line A, indicating your principal business activity. Use the related six-digit code found in the Principal Business Activity Codes.

- On Line B, enter the principal business activity code corresponding to your business type.

- If you have an Employer Identification Number (EIN), enter it on Line D. Otherwise, leave this field blank.

- Describe your business activity on Line F, outlining the main services or goods you provide.

- Proceed to Part I of the form to report your gross income, including any amounts from Forms 1099-MISC received.

- In Part II, list your business expenses, making sure to include only those directly associated with your business operations.

- Calculate your net profit or loss by subtracting your total expenses from your gross income in Part III.

- Review all entries for accuracy and completeness before proceeding to submit the form.

- Once all information has been verified, save changes, download for your records, or share according to your preferences.

Complete your IRS Schedule C online now for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Commissions and fees reported on Schedule C include payments you receive for services rendered, which are not categorized as salary or wages. This can encompass a variety of earnings, such as sales commissions or fees for freelance services. It is crucial to accurately report these amounts as they directly impact your taxable income. Reviewing the IRS Instructions 1040 Schedule C will help clarify these definitions and ensure proper filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.