Loading

Get Irs Instruction W-2g & 5754 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction W-2G & 5754 online

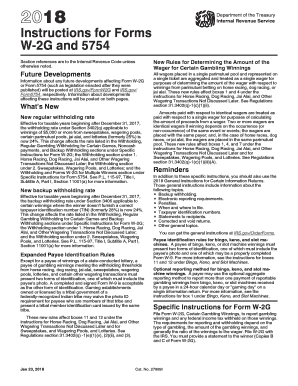

Filling out the IRS Instruction W-2G and Form 5754 online is an essential process for reporting certain gambling winnings and any associated federal taxes withheld. This guide provides a comprehensive overview of each section and field of the form, enabling users to complete it accurately and efficiently.

Follow the steps to effectively fill out the IRS Instruction W-2G & 5754 online.

- Use the ‘Get Form’ button to obtain the W-2G and 5754 forms. This action allows you to access the forms in an online editor for completion.

- Begin by identifying the type of gambling winnings that apply. Review each category such as horse racing, lotteries, or poker tournaments to determine which applies to your situation.

- Fill out the recipient’s information. Enter the name, address, and taxpayer identification number (TIN) of the individual receiving the winnings. If there are multiple winners, utilize Form 5754 to delineate their respective shares.

- Report the amount of gambling winnings. Ensure that you properly subtract any wagers and input the correct amount into the designated box on the forms, taking care to meet the minimal reporting thresholds.

- Input the federal income tax withheld, if applicable. This is crucial as it impacts the total taxes owed or refundable. Fill in the relevant box with the amount withheld, based on the type of gambling and the associated tax rate.

- Complete any required state or local tax information. If state income tax was withheld, fill in the appropriate boxes for state and local taxes.

- Double-check all entered information for accuracy. Ensure that all names, amounts and identification numbers are correct to prevent errors in processing.

- Once you have completed the forms, you can save your changes, download the finished documents, and print or share them as needed. Confirm that you keep copies for your records.

Start the process now by filling out your IRS Instruction W-2G and 5754 forms online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file W2G online through various tax preparation software. Many popular platforms, including those that align with IRS Instruction W-2G & 5754, allow you to enter and submit your W2G data electronically. This method streamlines the filing process and can speed up your tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.