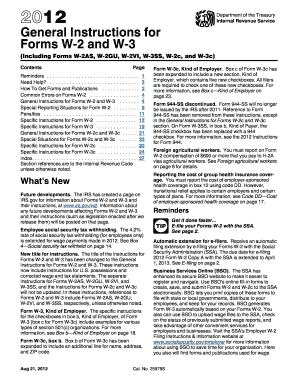

Get Irs Instruction W-2 & W-3 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction W-2 & W-3 online

Navigating the IRS Instruction W-2 & W-3 forms can be straightforward with the right guidance. This comprehensive guide will provide you with clear, step-by-step instructions on how to fill out these forms online, ensuring that you understand each component and its purpose.

Follow the steps to complete the IRS Instruction W-2 & W-3 forms online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the W-2 form section which includes information about wages, tips, and other compensation. Accurately enter the total amount in the designated field.

- In the next section, fill out the appropriate identification numbers, including the employer identification number (EIN) and any required state ID numbers.

- Complete the employee section by providing the individual's name, address, and social security number. Ensure all details are typed without errors for accurate filing.

- Proceed to the tax withheld section where you will indicate federal, state, and local income taxes withheld from the employee's paycheck.

- For the W-3 form, summarize the total number of W-2 forms being submitted and the total amounts reported. This is essential for accurate reporting to the IRS.

- Once all fields are filled out correctly, verify your information for accuracy. Make any necessary adjustments.

- Finally, save your changes, then download, print, or share the completed forms as needed.

Start filling out your IRS forms online today to ensure timely and accurate submissions.

Get form

Related links form

You can access your W-2 forms by contacting your employer for a physical copy or by checking any online payroll service they may use. Alternatively, the IRS Instruction W-2 & W-3 provides guidelines for accessing copies if you cannot obtain them directly from your employer. For a comprehensive solution, consider using UsLegalForms, which can help you navigate the process of acquiring the necessary tax documents easily.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.