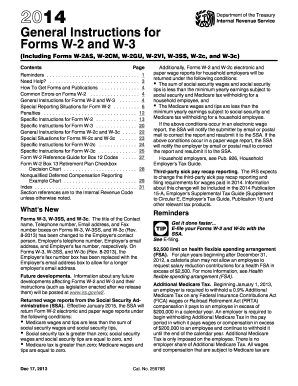

Get Irs Instruction W-2 & W-3 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Instruction W-2 & W-3 online

How to fill out and sign IRS Instruction W-2 & W-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren’t affiliated with document management and legal processes, submitting IRS documents can be rather tiring. We recognize the significance of accurately completing documents.

Our platform offers the functionality to simplify the task of filling out IRS forms as much as possible. Follow these guidelines to swiftly and correctly submit IRS Instruction W-2 & W-3.

Utilizing our online software can undoubtedly make proficient filling of IRS Instruction W-2 & W-3 achievable. Ensure everything is tailored for your comfort and ease of work.

- Click the button Get Form to access it and start editing.

- Complete all required fields in the document with our advanced PDF editor. Turn on the Wizard Tool to make the process even easier.

- Verify the accuracy of provided information.

- Include the completion date for IRS Instruction W-2 & W-3. Utilize the Sign Tool to create your signature for record validation.

- Conclude editing by clicking Done.

- Send this document directly to the IRS in the most convenient way for you: via email, using digital fax, or postal service.

- You can print it out on paper when a hard copy is necessary and download or save it to your preferred cloud storage.

How to revise Obtain IRS Guidance W-2 & W-3 2014: personalize forms online

Authorize and distribute Obtain IRS Guidance W-2 & W-3 2014 along with any other business and personal records online without squandering time and resources on printing and mailing. Make the most of our online document editor featuring an integrated compliant eSignature option.

Approving and submitting Obtain IRS Guidance W-2 & W-3 2014 documents digitally is swifter and more efficient than handling them in print. Nonetheless, it necessitates the use of online solutions that guarantee a high level of data security and provide you with a compliant tool for creating electronic signatures. Our robust online editor is exactly what you need to finalize your Obtain IRS Guidance W-2 & W-3 2014 and other personal and business or tax forms accurately and appropriately in accordance with all requirements. It supplies all the vital tools to swiftly and effortlessly complete, amend, and sign documents online and integrate Signature fields for others, indicating who and where they should sign.

It requires just a few straightforward steps to finalize and sign Obtain IRS Guidance W-2 & W-3 2014 online:

Distribute your documents with others utilizing one of the available methods. When authorizing Obtain IRS Guidance W-2 & W-3 2014 with our comprehensive online solution, you can always be confident it is legally binding and admissible in court. Prepare and submit documentation in the most efficient manner possible!

- Open the selected file for additional management.

- Utilize the top panel to insert Text, Initials, Image, Check, and Cross marks into your template.

- Highlight the significant details and blackout or delete sensitive information if necessary.

- Click the Sign option above and select how you wish to eSign your document.

- Sketch your signature, type it, upload its image, or use any other option that fits your needs.

- Switch to the Edit Fillable Fields panel and drop Signature areas for others.

- Click on Add Signer and enter your recipient's email to allocate this field to them.

- Verify that all provided data is complete and accurate before clicking Done.

Get form

Related links form

You can access your W-2 easily by logging into your employer's payroll system or requesting a copy directly from them. If you encounter difficulties, the IRS provides clear steps outlined in IRS Instruction W-2 & W-3 to help you obtain your form. Additionally, uslegalforms offers resources that simplify the process, ensuring you can easily retrieve your W-2 without stress.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.