Loading

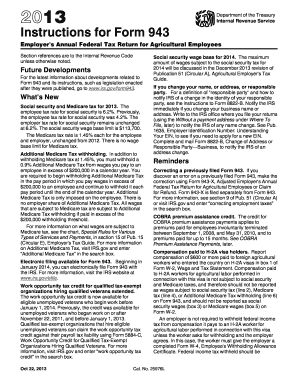

Get Irs Instruction 943 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 943 online

Filling out the IRS Instruction 943 may seem daunting, but this guide will provide you with clear, step-by-step instructions to complete the form smoothly. Understanding each section and field will help ensure your compliance with tax regulations for agricultural employees.

Follow the steps to complete the IRS Instruction 943 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Employer Identification Number (EIN) in the designated field. If you do not have an EIN, make sure to apply for one before proceeding.

- Indicate the number of agricultural employees on your payroll during the pay period that included March 12, ensuring you do not include household employees or individuals who did not receive payment.

- Input the total cash wages subject to social security tax paid to your employees for farmwork during the calendar year. Ensure that this amount is entered before any deductions.

- Enter the total cash wages subject to Medicare tax in the appropriate section, also prior to deductions. There is no limit on the amount of wages subject to Medicare tax.

- Calculate and report any federal income tax withheld from the wages paid to employees in the designated field.

- Complete any necessary adjustments to taxes in the dedicated section, such as for uncollected employee shares from third-party sick pay.

- After completing all relevant fields, review the form for accuracy to avoid any penalties or issues.

- Once satisfied with the information entered, you may save changes, download, print, or share the form as necessary.

Start completing your IRS Instruction 943 online to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 944 is designed for small employers with an annual payroll tax liability of $1,000 or less. If you qualify under this threshold, IRS Instruction 943 would not apply, and instead, you should file Form 944. Understanding your filing requirements helps avoid confusion and ensures you're meeting tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.