Get Irs Instruction 943 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS Instruction 943 online

How to fill out and sign IRS Instruction 943 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren’t linked with document handling and legal procedures, completing IRS forms can be quite challenging. We recognize the importance of accurately filling out forms.

Our service offers the solution to simplify the process of submitting IRS forms as much as possible. Adhere to these instructions to accurately and swiftly file IRS Instruction 943.

Using our comprehensive solution can certainly make proficiently filling out IRS Instruction 943 feasible. We will ensure everything is arranged for your ease and convenience.

Press the button Get Form to access it and begin editing.

Complete all mandatory fields in your form using our sophisticated PDF editor. Activate the Wizard Tool to make the process even simpler.

Verify the accuracy of the filled information.

Include the date of completion for IRS Instruction 943. Use the Sign Tool to create a unique signature for the document validation.

Finish editing by clicking on Done.

Transmit this document to the IRS in the most convenient way for you: via email, using digital fax, or postal mail.

You can print it on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to revise Get IRS Instruction 943 2014: personalize forms online

Utilize our sophisticated editor to convert a basic online template into a finished document. Continue reading to discover how to amend Get IRS Instruction 943 2014 online with ease.

Once you locate an ideal Get IRS Instruction 943 2014, all you need to do is modify the template to suit your necessities or legal standards. In addition to filling out the editable form with precise information, you might wish to eliminate some clauses in the document that are irrelevant to your situation. Conversely, you may want to incorporate some absent conditions in the original form. Our advanced document editing tools are the most straightforward method to amend and adjust the document.

The editor permits you to alter the content of any form, even if the file is in PDF format. You can insert and delete text, add fillable fields, and implement additional modifications while preserving the original layout of the document. You can also reorganize the arrangement of the document by altering the page sequence.

You don’t need to print the Get IRS Instruction 943 2014 to sign it. The editor includes electronic signature capabilities. Most of the forms already contain signature fields. Thus, you merely need to insert your signature and request one from the other signing party via email.

Adhere to this step-by-step guide to create your Get IRS Instruction 943 2014:

Once all parties sign the document, you will receive a signed copy that you can download, print, and share with others.

Our solutions allow you to save a significant amount of time and decrease the likelihood of an error in your documents. Enhance your document workflows with effective editing capabilities and a robust eSignature solution.

- Open the chosen form.

- Utilize the toolbar to customize the form according to your preferences.

- Complete the form with accurate details.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to additional signers if required.

Get form

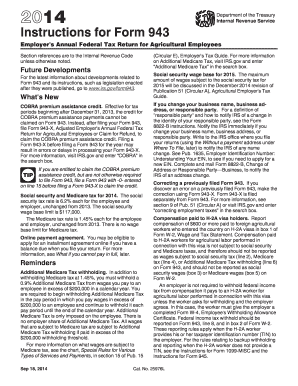

Generally, you do not need to file both Form 941 and Form 943. IRS Instruction 943 is tailored for agricultural employers, so if your business operates in that sector, direct your attention to 943. Assess your business category to determine the appropriate filings to maintain compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.