Loading

Get Irs Instruction 8863 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 8863 online

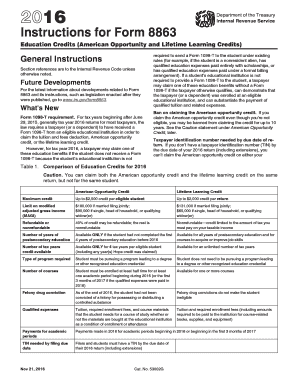

Filling out IRS Instruction 8863, which is used to claim education credits, can be straightforward with the right guidance. This guide will help you navigate through the process of completing the form online, ensuring you can effectively utilize the available tax benefits for education.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to download the form and open it for editing.

- Review the general instructions carefully to understand the requirements for claiming education credits. Ensure you meet eligibility criteria such as having a valid Taxpayer Identification Number and awareness of the Form 1098-T requirements.

- On the form, begin by entering your personal information, including your name and Social Security Number or Taxpayer Identification Number in the designated fields.

- Read through Part I where you will calculate the refundable American Opportunity Credit, entering adjusted qualified education expenses for eligible students.

- Proceed to Part II to calculate any nonrefundable credits based on the lifetime learning credit, noting the limits and conditions applicable to your situation.

- If you are claiming education credits for dependents, ensure you complete a separate Part III for each individual, providing necessary information regarding their education institution and expenses.

- Double-check all entries for accuracy, especially regarding the modified adjusted gross income and any adjustments related to tax-free educational assistance or refunds.

- Once you have filled out the form, save your changes. You can download, print, or share the completed form according to your needs.

Complete your documents online to maximize your education tax credits efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Several factors could disqualify you from claiming the American Opportunity Credit. These include prior claims of the credit for four tax years, enrollment in a program less than half-time, or felony drug convictions. IRS Instruction 8863 lays out these disqualifications explicitly, allowing you to gauge your eligibility accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.