Loading

Get Irs Instruction 843 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 843 online

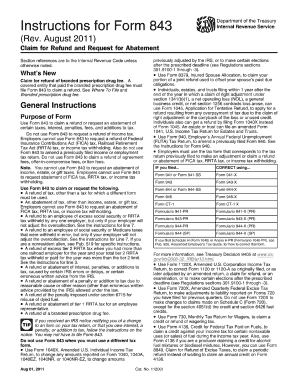

Filling out Form 843, the claim for refund and request for abatement, can be a straightforward process when guided correctly. This form allows individuals to claim refunds or request abatements for certain taxes, interest, penalties, and fees. Follow these instructions to complete the form accurately online.

Follow the steps to complete Form 843 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your social security number in the designated field. If filing jointly, also include your partner's social security number.

- Fill in the tax period for which you are making the claim for refund or abatement. If requesting a refund for a branded prescription drug fee, specify the fee year on the 'From' line.

- Check the appropriate box indicating the type of tax or fee related to your claim. If applicable, provide details about interest, penalties, or additions to tax.

- If claiming a refund of excessive tiers for RRTA or similar, complete lines 1, 2, and 3. Provide necessary documentation such as Forms W-2.

- If applicable, provide a detailed explanation for your claim on Line 7, including a computation for the refund or abatement requested.

- Once all fields are filled and reviewed for accuracy, you can save changes, download the form for your records, or print it for mailing.

Start filling out your IRS Form 843 online today to ensure timely processing of your claim.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can find the IRS instruction booklet, including guidelines on completing Form 843, on the official IRS website. Simply navigate to the forms and publications section, and look for Form 843. Alternatively, you can also download it directly. The IRS Instruction 843 will have all the detailed information you need.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.