Get Irs Instruction 843 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 843 online

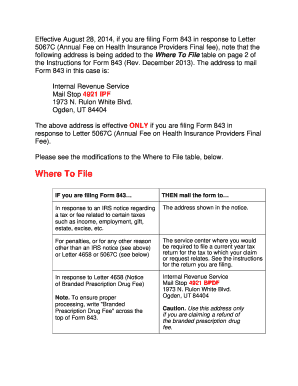

The IRS Instruction 843 form is used to claim refunds or request abatements of certain taxes, penalties, and fees. This guide is designed to provide clear, step-by-step instructions to help users complete the form accurately in an online environment.

Follow the steps to complete the IRS Instruction 843 with ease.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your social security number (SSN) in the designated field. If applicable, include the SSNs for both you and your partner if filing jointly.

- Specify the tax period for which you are making a claim in the appropriate line. If you are requesting a refund for a branded prescription drug fee, be sure to indicate the fee year on the 'From' line.

- In the next section, check the appropriate box indicating the type of tax or fee for your claim. This helps categorize your request correctly.

- Provide detailed information on line 7 explaining the reasons for your claim along with any necessary computations for the refund or abatement.

- Attach all required supporting documents, such as any prior correspondence from the IRS, forms W-2 if applicable, or additional statements explaining your claim.

- Once all fields are completed and documents are attached, review your form for accuracy. Save your changes in the online editor.

- Finally, choose to download, print, or share your completed form as required for submission to the IRS.

To ensure you receive any refunds or abatements you're entitled to, complete your IRS Instruction 843 form online today.

Get form

An IRS underpayment penalty can be caused by various factors, including underestimating your income, failing to make adequate payments, or a change in your tax situation that went unaddressed. Life events such as job loss or significant income fluctuations can also contribute. Staying informed through IRS Instruction 843 can help you mitigate these risks and understand your obligations more clearly. Consider using resources like US Legal Forms to stay on track with your tax responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.