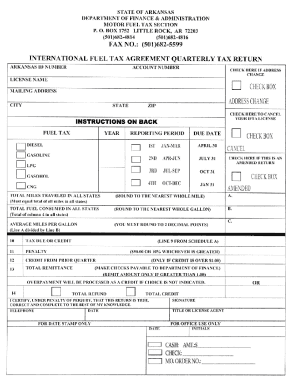

Get Ar International Fuel Tax Agreement Quarterly Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AR International Fuel Tax Agreement Quarterly Tax Return online

How to fill out and sign AR International Fuel Tax Agreement Quarterly Tax Return online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period commenced unexpectedly or you simply overlooked it, it may likely lead to complications for you.

AR International Fuel Tax Agreement Quarterly Tax Return is certainly not the easiest one, but there is no reason for alarm in any circumstance.

With our robust digital solution and its useful tools, submitting the AR International Fuel Tax Agreement Quarterly Tax Return becomes more efficient. Do not hesitate to utilize it and dedicate more time to hobbies instead of paperwork.

- Access the document in our robust PDF editor.

- Complete all the required details in the AR International Fuel Tax Agreement Quarterly Tax Return, utilizing the fillable fields.

- Add images, checks, and text boxes, as needed.

- Repetitive information will be automatically populated following the initial entry.

- If issues arise, activate the Wizard Tool. You will get guidance for easier submission.

- Remember to include the filing date.

- Generate your distinctive e-signature once and position it in all the necessary locations.

- Review the information you have entered. Rectify errors if needed.

- Hit Done to conclude editing and select your method of submission. You will have the option to use digital fax, USPS, or email.

- You can also download the file to print it later or upload it to cloud storage such as Dropbox, OneDrive, etc.

How to Alter the Get AR International Fuel Tax Agreement Quarterly Tax Return: Personalize Forms Online

Ditch the conventional paper-based method of filling out the Get AR International Fuel Tax Agreement Quarterly Tax Return. Have the document completed and endorsed in no time using our exceptional online editor.

Are you compelled to modify and complete the Get AR International Fuel Tax Agreement Quarterly Tax Return? With a powerful editor like ours, you can finalize this in just minutes without the hassle of printing and scanning paperwork repeatedly. We offer entirely customizable and user-friendly form templates that will serve as a foundation to assist you in filling out the necessary form online.

All documents, automatically, feature fillable fields that you can use as soon as you access the template. However, should you wish to enhance the existing content of the document or insert new information, you can choose from an array of customization and annotation tools. Emphasize, redact, and comment on the text; insert checkmarks, lines, text boxes, graphics, notes, and comments. Moreover, you can quickly sign the template with a legally binding signature. The finalized document can be shared with others, stored, dispatched to external applications, or converted into any popular format.

You’ll never err by selecting our web-based solution to complete the Get AR International Fuel Tax Agreement Quarterly Tax Return because it's:

Don't squander time editing your Get AR International Fuel Tax Agreement Quarterly Tax Return the outdated way—with pen and paper. Utilize our comprehensive option instead. It offers you a flexible array of editing tools, integrated eSignature functionalities, and convenience. What sets it apart from comparable alternatives is the collaborative team options—you can collaborate on documents with anyone, establish a well-structured document approval workflow from scratch, and much more. Experiment with our online tool and receive the best value for your investment!

- Simple to set up and operate, even for individuals who haven’t completed paperwork electronically before.

- Robust enough to support various editing requirements and form types.

- Safe and secure, ensuring your editing experience is protected each time.

- Accessible across multiple operating systems, making it easy to fill out the form from anywhere.

- Capable of producing forms based on pre-drafted templates.

- Compatible with a variety of document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

For successful IFTA reporting, you need a detailed account of miles traveled and fuel consumed in each state where your vehicle operates. Essential documents include fuel receipts, trip sheets, and any other records that validate your data. By using tools provided by platforms like uslegalforms, you can effectively gather and utilize this information for your AR International Fuel Tax Agreement Quarterly Tax Return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.