Get Irs Instruction 7004 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 7004 online

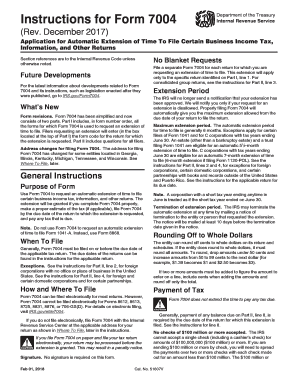

Filling out the IRS Instruction 7004 is essential for requesting an automatic extension of time to file certain business income tax returns. This guide provides a clear and detailed process for completing the form online, ensuring users can successfully navigate each requirement.

Follow the steps to fill out the IRS Instruction 7004 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Part I, enter the appropriate form code for the return related to the extension request in the designated box at the top. Make sure to check the latest IRS guidelines for form codes.

- Proceed to Part II, where all filers must answer questions. Check the box if you are a foreign corporation requesting an extension.

- Provide your name, the identifying number, and the entity's address accurately. If your name has changed, ensure it matches the previous year's tax return.

- Complete Line 5 by entering the beginning and ending dates for the tax year if not using a calendar year.

- Estimate your total tax for the year and enter this amount on Line 6. This is crucial even if you expect a zero amount.

- On Line 7, record the total payments and refundable credits made towards your expected tax liability.

- Finally, review all entries for accuracy. Once confirmed, users can save changes, download, print, or share the completed form as needed.

Start filling out your IRS Form 7004 online today to ensure timely compliance.

Get form

The IRS additional extension is an option that some taxpayers may qualify for under certain circumstances. Generally, if you have filed IRS Instruction 7004 or form 4868, you may be eligible for a further extension. However, this additional extension is typically not granted automatically and may require specific justifications. Always check IRS guidelines to ensure compliance and thoroughness in your tax filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.