Loading

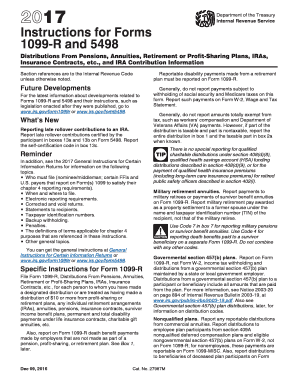

Get Irs Instruction 1099-r & 5498 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1099-R & 5498 online

Filling out the IRS Instruction forms 1099-R and 5498 can be a daunting task without proper guidance. This comprehensive guide provides clear and supportive instructions tailored to users of all backgrounds for completing these forms online.

Follow the steps to fill out the IRS Instruction 1099-R & 5498 online effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred digital document editor.

- Begin with Form 1099-R. In Box 1, enter the total amount of the gross distribution before any tax withholdings.

- In Box 2a, enter the taxable amount, if known; otherwise, leave it blank and check the ‘Taxable amount not determined’ box.

- Proceed to Box 7 and select the appropriate distribution code(s) from the guide provided.

- If applicable, fill in the necessary information regarding nonperiodic distributions or rollovers in subsequent boxes.

- Next, switch to Form 5498. In Box 1, report traditional IRA contributions made in 2017 and through April 17, 2018.

- Enter any rollover contributions in Box 2; do not place rollovers in Box 1.

- In Box 5, indicate the fair market value of the account as of December 31, 2017.

- Complete any remaining boxes as necessary, following the specific instructions provided for each.

- Save changes to the document, and download, print, or share the forms as required.

Start filling out your IRS Instruction 1099-R & 5498 forms online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, the amount reported on your 1099-R is generally considered taxable income. This means it should be included when calculating your total income for tax purposes. When in doubt, refer to IRS Instruction 1099-R & 5498 to ensure accurate reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.