Loading

Get Irs Instruction 1099-div 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1099-DIV online

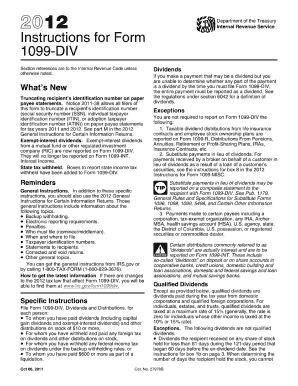

Filling out the IRS Instruction 1099-DIV online is an essential task for those reporting dividends and distributions. This guide will provide you with a clear, step-by-step approach to ensure accuracy in completing this important tax form.

Follow the steps to successfully complete your 1099-DIV form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the form, provide your information in the designated box, including your name and taxpayer identification number. This identification is crucial for the IRS to match your submissions accurately.

- Next, enter the recipient's information in the appropriate sections, including their name, address, and taxpayer identification number. These details are essential for correctly assigning dividends to the right individual.

- Fill in box 1a to report total ordinary dividends. This includes all varieties of dividends paid to the recipient. Make sure to include any reinvested dividends and section 404(k) dividends.

- If any of the ordinary dividends qualify for capital gains rates, enter the amount in box 1b. Be aware of the holding period requirements that determine whether dividends qualify.

- Proceed to box 2a to report total capital gain distributions. Ensure that you include any amounts from boxes 2b, 2c, and 2d that pertain to the capital gains.

- In box 4, report any federal income tax that was withheld, if applicable. This is important for compliance with withholding regulations.

- Once all boxes are filled accurately, review the form for any errors. It is vital to verify all information before submission to avoid potential fines or delays.

- After confirming the accuracy, proceed to save your changes. You can download or print the form for your records and submit it as required.

Start filling out your IRS 1099-DIV form online today to ensure timely and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you must report all 1099 income, even if it is less than $600. The IRS requires you to include these income amounts in your total earnings. By following IRS Instruction 1099-DIV, you can avoid potential tax issues and ensure accurate reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.