Loading

Get Ar Dfa Ar3mar 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR3MAR online

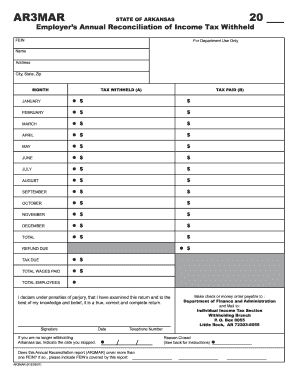

Filling out the AR DFA AR3MAR form is an essential part of verifying income tax withheld by employers in Arkansas. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to accurately complete your AR DFA AR3MAR form.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- Begin by entering the tax year in the designated field at the top of the form.

- Fill in your Federal Employer Identification Number (FEIN) in the provided space.

- Complete the name, address, city, state, and zip code fields to provide your business information.

- For each month, enter the total tax withheld in Column A and the actual tax paid in Column B for all twelve months.

- Calculate the total amounts in Column A and write the sum in the designated total box. Ensure this matches your totals from the W-2 forms.

- Report the total wages paid and total number of employees in the relevant boxes.

- If the total tax paid in Column B exceeds the tax withheld in Column A, write the refund due amount in the corresponding field. If the opposite is true, note the tax due amount and prepare to attach a check.

- If applicable, enter the date you ceased withholding Arkansas taxes and the reason for closure from the provided list.

- Review the entire form for accuracy, then save your changes. You can download, print, or share your completed form as needed.

Complete your AR DFA AR3MAR form online now to ensure compliance and accurate reporting.

Related links form

You should mail your completed AR3MAR form to the address specified on the form itself. Generally, the address will correspond to your applicable tax district in Arkansas. Mailing your AR DFA AR3MAR to the correct address ensures that your filing is processed in a timely manner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.