Get Irs Instruction 1065 - Schedule K-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

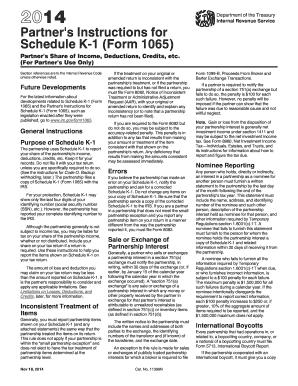

The IRS Instruction 1065 - Schedule K-1 is essential for partners in a partnership to report their share of income, deductions, credits, and other tax items. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring that users with varied levels of experience can accurately fulfill their tax responsibilities.

Follow the steps to accurately complete your Schedule K-1 online.

- Click ‘Get Form’ button to access and download the Schedule K-1 form.

- Identify the partnership's information, such as its name and identifying number, which you will enter in the designated fields.

- Provide your personal information, including your name, address, and taxpayer identification number, in the partner's section.

- Fill in your share of the partnership’s income, deductions, credits, and other items as reported by the partnership, ensuring accuracy and alignment with partnership records.

- Review the IRS instructions related to special sections within the form (e.g., passive activity limitations, at-risk rules) to ensure compliance with tax laws.

- If applicable, input any adjustments to your basis in the partnership based on distributions or contributions during the tax year.

- Complete the necessary calculations, ensuring all amounts are transferable to your tax return, and keep records of all figures reported on Schedule K-1.

- Upon completing the form, save your changes, and retain a secure copy for your records. Options may include downloading, printing, or sharing the completed form as needed.

Start your online filing journey for the IRS Instruction 1065 - Schedule K-1 today!

Get form

Related links form

Income received from a K-1 trust is typically taxable and must be reported on your tax return. Trusts are often required to distribute income to beneficiaries, and that income is passed through on their K-1. Referencing IRS Instruction 1065 - Schedule K-1 can clarify the tax obligations associated with income from trusts, ensuring you remain compliant.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.