Get Irs Instruction 1045 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1045 online

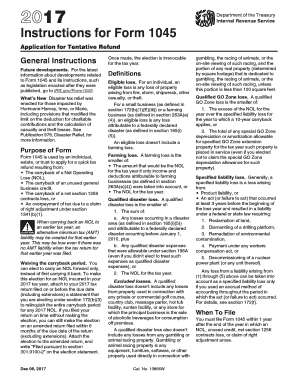

IRS Instruction 1045 provides guidance for individuals, estates, or trusts seeking to apply for a quick tax refund due to various types of losses or overpayments. Understanding how to fill out Form 1045 correctly is essential to ensure a smooth refund process.

Follow the steps to complete the IRS Instruction 1045 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Enter your personal information at the top of the form, including your name, address, and taxpayer identification number. Ensure all details are accurate.

- Complete Line 1 to indicate the type of loss you are claiming, choosing from the provided categories such as Net Operating Loss (NOL) or unused general business credit.

- For Line 1b regarding unused general business credit, attach detailed calculations demonstrating your credit carryback.

- In Line 1c, if applicable, detail any net section 1256 contracts loss you are carrying back and include the required Form 6781.

- Progress through Lines 10 through 32 to calculate the decrease in tax previously determined for each applicable carryback year.

- If your claim includes any exemptions, re-calculate them based on your adjusted gross income as shown on Line 11.

- Finalize any deductions or credits, ensuring you refigure any that depend on your AGI or are affected by the carryback.

- Review all entries for accuracy before signing the form at the end where indicated—if filed jointly, both partners must sign.

- Lastly, save your completed form, download it if necessary, and consider your options for printing or sharing it as required.

Begin the process to complete your IRS Instruction 1045 online today to ensure you receive your refund promptly.

Get form

Related links form

The primary difference between IRS Form 1040X and Form 1045 is their purpose. Form 1040X is used to amend a previously filed individual tax return, while Form 1045 is specifically for claiming a quick refund due to a net operating loss. Understanding IRS Instruction 1045 is vital when you're looking to expedite a refund process, especially if you're filing based on losses. Each form serves different needs and situations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.