Loading

Get Irs Instruction 1040 Line 51 2011-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1040 Line 51 online

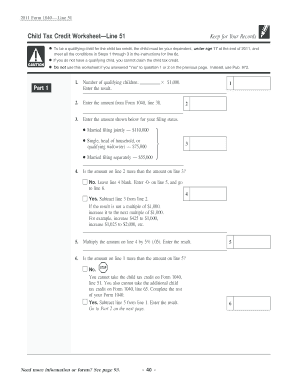

Filling out the IRS Instruction 1040 Line 51 is essential for claiming the child tax credit. This guide provides a clear and concise explanation of the necessary steps to complete this section efficiently online.

Follow the steps to complete Line 51 of your IRS Instruction 1040

- Select the ‘Get Form’ button to obtain the IRS Form 1040 and open it in your editing tool.

- Begin by determining the number of qualifying children. Enter this number in Box 1.

- Enter the amount from Form 1040, line 38 in Box 2.

- Refer to the following amounts based on your filing status and input the corresponding amount in Box 3: Married filing jointly — $110,000; Single, head of household, or qualifying widow(er) — $75,000; Married filing separately — $55,000.

- In Box 4, evaluate if the amount in Box 2 exceeds the amount in Box 3. If not, leave Box 4 blank and enter -0- in Box 5; proceed to Box 6.

- If the amount in Box 2 is greater than Box 3, subtract Box 3 from Box 2. If the result is not a multiple of $1,000, round it up to the next multiple of $1,000.

- Multiply the amount from Box 4 by 5% (0.05) and enter the result in Box 5.

- For Box 6, determine if the amount in Box 1 is greater than the amount in Box 5. If it is not, stop here as you cannot claim the child tax credit.

- If it is, subtract Box 5 from Box 1 and enter the result. Proceed to Part 2.

- For Part 2, enter the amount from Form 1040, line 46 in Box 7 and add other relevant amounts in Box 8.

- In Box 9, check if the amounts in Box 7 and Box 8 are equal. If they are, stop as there is no tax to reduce.

- If not, subtract Box 8 from Box 7. Then, determine whether the amount in Box 6 is greater than the amount in Box 9 for Box 10.

- Finally, enter the applicable amount in Box 51 of Form 1040 as your child tax credit.

Complete your IRS documents online today for a seamless filing experience.

A zero tax return is common for certain individuals, particularly if your total income results in no tax liability. However, it’s essential to ensure all income sources are reported appropriately. If you're uncertain how to prepare your return or calculate potential deductions, consider using the resources from UsLegalForms to simplify the process and follow IRS Instruction 1040 Line 51 effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.