Get Irs Foreign Account Or Asset Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Foreign Account or Asset Statement online

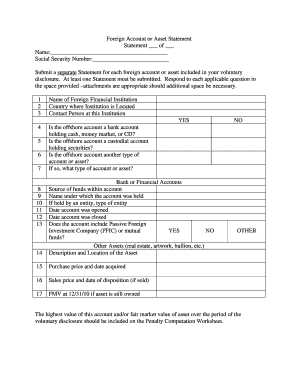

Filling out the IRS Foreign Account or Asset Statement is an important step for individuals reporting foreign financial interests. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form effectively

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field for clarity.

- Provide your Social Security number to ensure proper identification.

- For each foreign account or asset, a separate statement must be submitted. Be sure to fill out one statement for each applicable foreign account or asset included in your voluntary disclosure.

- Enter the name of the foreign financial institution in the appropriate space.

- Specify the country where the financial institution is located.

- List a contact person at the foreign institution for communication purposes.

- Indicate whether the offshore account is a bank account, custodial account, or another type of account or asset by selecting 'YES' or 'NO' as applicable.

- If the account is of another type, provide additional details on the type of account or asset.

- Fill in the required information regarding bank or financial accounts which include the source of funds, name under which the account was held, type of entity if applicable, date the account was opened, and date it was closed.

- Answer whether the account includes Passive Foreign Investment Company (PFIC) or mutual funds by selecting 'YES' or 'NO'.

- For other assets like real estate, artwork, or bullion, provide a description and location of the asset.

- Fill in the purchase price and date acquired for each asset.

- If sold, enter the sales price and date of disposition.

- Indicate the fair market value at the end of the applicable reporting period if the asset is still owned.

- Provide the highest value of the account or asset over the voluntary disclosure period to be documented on the Penalty Computation Worksheet.

- Once all sections are completed, review your entries for accuracy before proceeding.

- You may then save changes, download, print, or share the completed form as necessary.

Start filling out your IRS Foreign Account or Asset Statement online today.

The IRS has various mechanisms for discovering foreign accounts, including data sharing agreements with other countries and the implementation of the FATCA framework. These measures allow the IRS to access information regarding U.S. persons with foreign financial accounts. Therefore, it is crucial to ensure your IRS Foreign Account or Asset Statement is accurate and comprehensive. Partnering with uslegalforms may enhance your compliance strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.