Loading

Get Ar Dfa Ar1000anr 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA AR1000ANR online

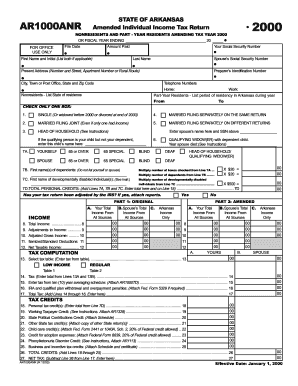

The AR DFA AR1000ANR is an amended individual income tax return specifically for nonresidents and part-year residents for the tax year 2000. This guide provides step-by-step instructions to help you accurately complete the form online.

Follow the steps to effectively fill out the AR DFA AR1000ANR online.

- Click the ‘Get Form’ button to download the AR DFA AR1000ANR and open it in the online editor.

- Enter your Social Security number in the designated field. Ensure that this information matches your legal documents.

- Provide your first name and initial, along with your last name. If applicable, also enter your spouse’s Social Security number.

- Fill in your present address, including the number and street, apartment number if needed, and city, state, and zip code.

- Input your telephone numbers for home and work if applicable. This information helps in case any follow-up is necessary.

- Nonresidents should list their state of residence, while part-year residents must indicate their period of residency in Arkansas.

- Select the correct filing status by checking one of the provided boxes (e.g., single, married filing jointly, head of household).

- For lines 7A through 7D, indicate any applicable personal credits and multiply as instructed.

- Fill out your total income and adjustments across the relevant income sections. Be sure to enter accurate figures.

- Complete the tax computation section by entering amounts from the tax tables provided.

- Proceed to the tax credits portion, making sure to enter any relevant credits to which you are entitled.

- After completing all sections, review the information for accuracy.

- Finally, save the completed form. You can download it, print it out for your records, or share it with others as needed.

Complete your AR DFA AR1000ANR online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain Arkansas tax forms, including the essential AR DFA AR1000ANR, directly from the Arkansas Department of Finance and Administration (DFA) website. The site offers an easy-to-navigate platform where you can download or print the forms you need. Alternatively, local government offices and libraries also provide physical copies if you prefer to pick them up in person.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.