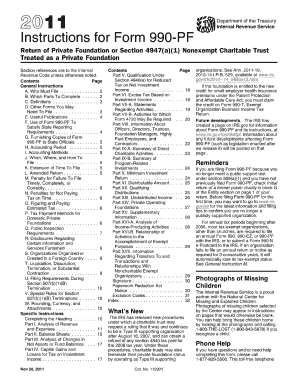

Get 990 Pf Instruction 2011 Form 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990 Pf Instruction 2011 Form online

Filling out the 990 Pf Instruction 2011 Form can seem daunting, but with careful attention to each section, you can navigate the process smoothly. This guide provides clear and concise instructions for completing the form online, ensuring compliance with IRS requirements.

Follow the steps to successfully complete the 990 Pf Instruction 2011 Form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the Heading section at the top of the form with the organization’s name, address, and employer identification number (EIN). Ensure that information is complete and accurate.

- Complete Part I for analysis of revenue and expenses. Report all relevant revenue and expenses applicable to the current tax year, including contributions and grants.

- Move on to Part II, Balance Sheets. Enter the beginning and end-of-year book values, as well as fair market values if applicable.

- Complete Parts III through XVII, carefully following the instructions for each section. Pay special attention to specific fields that require detailed information, such as officer compensation and charitable distributions.

- Review all provided information for accuracy and completeness. Ensure all calculations, especially for net investment income and qualifying distributions, are correct.

- Once all sections are completed, you can save changes, download, print, or share the form as per your filing needs.

Start filling out your 990 Pf Instruction 2011 Form online today to ensure compliance with IRS regulations.

Get form

Related links form

Yes, capital gain distributions are included in the calculation of distributable net income, affecting your foundation's minimum distribution requirements. When filling out the 990-PF, you should take this into account as it informs how much you must distribute to remain compliant. The 990 PF Instruction 2011 Form provides detailed instructions on how to handle these figures correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.