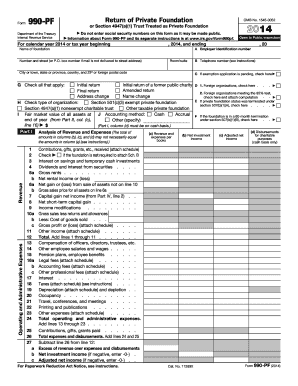

Get Irs 990-pf 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990-PF online

How to fill out and sign IRS 990-PF online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked to document management and legal procedures, completing IRS forms can be rather exhausting.

We understand the importance of accurately finalizing documents.

Utilizing our online software can undoubtedly transform the efficient completion of IRS 990-PF into a reality. We will ensure everything is arranged for your comfort and ease of work.

- Click on the button Get Form to access it and start editing.

- Complete all required fields in your document using our robust and user-friendly PDF editor. Activate the Wizard Tool to simplify the process significantly.

- Verify the accuracy of the provided information.

- Insert the date of completing IRS 990-PF. Use the Sign Tool to generate a personal signature for the document's validation.

- Finish editing by selecting Done.

- Transmit this document directly to the IRS in the most convenient way for you: via email, using virtual fax, or by mail.

- You can print it on paper when a physical copy is needed and download or save it to your preferred cloud storage.

How to amend Get IRS 990-PF 2014: alter forms online

Your easily adjustable and customizable Get IRS 990-PF 2014 template is at your fingertips. Maximize our collection with an integrated online editor.

Are you delaying completing Get IRS 990-PF 2014 because you just don’t know where to start and how to proceed? We empathize with your situation and have a fantastic answer for you that has nothing to do with tackling your procrastination!

Our online library of ready-to-edit templates allows you to sift through and choose from thousands of fillable forms tailored for various applications and circumstances. However, obtaining the file is merely the beginning. We provide you with all the essential tools to complete, sign, and modify the form of your choice without exiting our website.

Incorporate checkmarks, circles, arrows, and lines.

To summarize, along with Get IRS 990-PF 2014, you will receive:

An effective suite of editing and annotation tools.

- Simply launch the form in the editor.

- Examine the language of Get IRS 990-PF 2014 and confirm whether it matches your requirements.

- Initiate changes to the form using the annotation tools to enhance its organization and appearance.

- Emphasize, black out, and amend the existing text.

- If the form is intended for others as well, you can include fillable fields and share them for additional users to complete.

- Once you’re finished adjusting the template, you can obtain the document in any available format or select any sharing or delivery alternatives.

Get form

The IRS 990-PF itself is not tax-exempt; rather, it serves as a reporting form for private foundations. It provides the IRS with required information regarding income, expenses, and distributions while maintaining transparency. Understanding the nuances of the IRS 990-PF can be complex, but US Legal Forms can assist you with resources and templates for accurate reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.