Get Irs 990-pf 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990-PF online

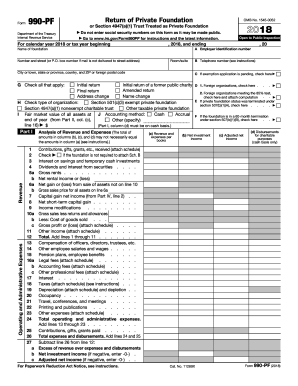

The IRS 990-PF is an essential form for private foundations, detailing their financial activities and ensuring compliance with tax regulations. This guide will provide clear, step-by-step instructions on how to complete this form online, making the process as straightforward as possible for users of all experience levels.

Follow the steps to complete the IRS 990-PF online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the basic information of the foundation, including the employer identification number, name, and address. Make sure to include the specific year for which you are filing.

- In Section C, indicate if an exemption application is pending and check all applicable boxes in Section G regarding the type of return you are submitting.

- Fill out Part I, detailing revenue and expenses. Focus on accurately entering amounts under the appropriate columns and attaching any required schedules, especially if contributions or grants are involved.

- Complete the balance sheets in Part II. It is crucial to ensure that all asset values correspond to fair market values and that liabilities are accurately reported.

- Proceed to Part III to analyze the foundation’s changes in net assets or fund balances from the accruals entered in previous sections.

- For Parts IV through VI, detail capital gains and losses, along with any applicable taxes on investment income. Ensure to follow the given instructions for calculations attentively.

- Fill out Parts VII through XV, providing information regarding activities, contributions, and any required supplementary information related to the foundation.

- Review your entries for accuracy and completeness. Once finalized, make sure to save the changes and know that you can download, print, or share the completed form as needed.

Start completing your IRS 990-PF online today!

Get form

To submit your PF Form 990, you can file electronically or via mail depending on your foundation's size and filing preferences. The IRS encourages electronic filing for easier processing and faster confirmation of receipt. For detailed instructions and support, consider using platforms like US Legal Forms, which can guide you through the process of completing and submitting IRS 990-PF accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.