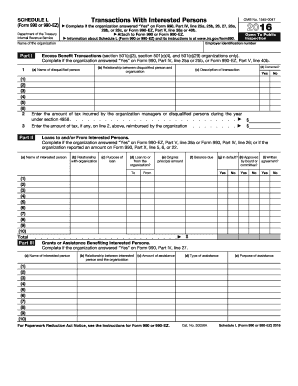

Get Irs 990 Or 990-ez - Schedule L 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 990 or 990-EZ - Schedule L online

Filling out the IRS 990 or 990-EZ - Schedule L is an important task for organizations engaging in transactions with interested persons. This guide provides detailed, step-by-step instructions to help you complete the form online accurately and efficiently.

Follow the steps to successfully complete Schedule L online.

- Click ‘Get Form’ button to retrieve the form and open it in the editor.

- Enter the employer identification number in the designated field. This number is vital for identifying your organization.

- In Part I, provide details on any excess benefit transactions involving disqualified persons. Identify the disqualified person’s name, relationship with the organization, a description of the transaction, and indicate if the transaction was corrected.

- Move to Part II to report loans to and from interested persons. Fill out the necessary information, including the name of the interested person, relationship with the organization, purpose of the loan, original principal amount, remaining balance due, and indicate whether the loan is in default.

- In Part III, document any grants or assistance benefiting interested persons. Include the name of the interested person, their relationship with your organization, the amount and type of assistance, and the purpose of that assistance.

- Proceed to Part IV to detail business transactions involving interested persons. Provide names, relationships, amounts, and descriptions of each transaction. Indicate whether there is a sharing of the organization’s revenues.

- Complete Part V by providing any supplemental information necessary to clarify your answers in Schedule L.

- Review your entries for accuracy. Once confirmed, proceed to save your changes, download, print, or share the completed form as needed.

Complete your IRS 990 or 990-EZ - Schedule L online today to ensure your organization remains compliant.

Get form

To fill out Form 990-EZ online, start by collecting all the necessary financial documents and data related to your organization. Use authorized tax preparation software or online platforms that support IRS 990 or 990-EZ forms. Many of these platforms guide you through the process step-by-step, ensuring compliance and accuracy. Don't hesitate to check out US Legal Forms for additional resources in filling out your forms correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.