Loading

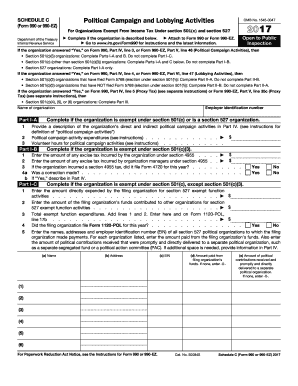

Get Irs 990 Or 990-ez - Schedule C 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 or 990-EZ - Schedule C online

Filling out the IRS 990 or 990-EZ - Schedule C can be a crucial step for organizations engaged in political campaign and lobbying activities. This guide will provide you with clear, step-by-step instructions to help you navigate and complete the form online effectively.

Follow the steps to successfully complete Schedule C.

- Click ‘Get Form’ button to access the document and open it in the editor.

- Begin by entering the name of your organization at the top of the form before proceeding to Parts I-A and I-B, which you will complete based on your organization's tax-exempt status.

- In Part I-A, provide the amount of any excise tax incurred under section 4955 and indicate if corrections were made. This part is for organizations exempt under section 501(c)(3).

- Complete Part I-B if your organization is exempt under section 501(c), except section 501(c)(3). This will include detailing any expenditures made for section 527 exempt function activities.

- Move on to Part I-C to describe the political campaign activities of your organization. Report on expenditures and volunteer hours dedicated to these activities.

- If applicable, complete Part II-A or II-B depending on whether your organization has filed Form 5768 concerning lobbying activities. Detail your expenditures as necessary.

- For section 501(c)(4), (5), or (6) organizations, complete Part III by answering questions regarding dues and lobbying expenditures.

- Lastly, provide any additional descriptions or information required in Part IV for clarity and completeness. This includes supplemental information on affiliated groups, lobbying activities, and political campaign activities.

- Once all sections are complete, save your changes, and utilize the options to download, print, or share the form as needed.

Start filling out your Schedule C online today to ensure compliance with IRS requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, organizations can switch from filing Form 990 to Form 990-EZ if they meet the qualifying criteria. This change is typically feasible for organizations that experience a decrease in gross receipts over a reporting period. To maintain compliance with IRS 990 or 990-EZ - Schedule C, review your financials thoroughly and consider using uslegalforms for assistance in this transition.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.