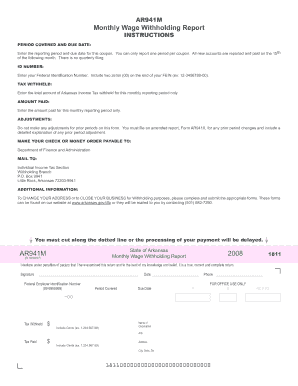

Get Ar Ar941m 2008-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AR AR941M online

How to fill out and sign AR AR941M online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period began unexpectedly or you perhaps simply overlooked it, it could likely lead to issues for you. AR AR941M isn’t the most straightforward, but you need not be concerned in any situation.

By utilizing our user-friendly platform, you will discover how to fill out AR AR941M even in circumstances of significant time constraints. You only need to adhere to these straightforward guidelines:

With our efficient digital tool and its supportive features, submitting AR AR941M becomes more convenient. Don’t hesitate to utilize it and spend additional time on activities you enjoy instead of preparing documents.

- Access the document in our robust PDF editor.

- Complete the details required in AR AR941M, using fillable fields.

- Add visuals, checks, ticks, and text boxes, if necessary.

- Repetitive data will be included automatically after the initial entry.

- If you encounter any challenges, activate the Wizard Tool. You will receive some advice for easier completion.

- Remember to add the application date.

- Create your personalized e-signature once and place it in the designated areas.

- Review the information you have entered. Amend errors if necessary.

- Press Done to finalize editing and choose how you will submit it. You can opt for digital fax, USPS, or email.

- It is possible to download the document for later printing or upload it to cloud storage.

How to Adjust Get AR AR941M 2008: Tailor Forms Online

Select the appropriate Get AR AR941M 2008 template and alter it instantly.

Streamline your documentation with an intelligent form editing solution available online.

Your everyday tasks involving documentation and forms can be enhanced when you have all you need consolidated in one location. For example, you can locate, retrieve, and alter Get AR AR941M 2008 all from a single browser tab.

If you're looking for a particular Get AR AR941M 2008, finding it is easy with the assistance of the intelligent search tool, allowing immediate access without the need to download or find an external editor to change it and include your information. All tools for effective work come in one complete solution.

Enhance your custom adjustments with the available features.

- This editing tool allows you to customize, complete, and sign your Get AR AR941M 2008 form directly.

- After locating the suitable template, click on it to enter the editing mode.

- Upon opening the form in the editor, all necessary instruments are at your disposal.

- You can conveniently fill in the specified fields and delete them if required using a straightforward yet versatile toolbar.

- Make all modifications immediately, and sign the form without leaving the tab by simply clicking the signature area.

Related links form

Yes, if you earn income in Arkansas, you are generally required to file an Arkansas state tax return. This includes submitting forms like the AR941M, which reports your withholding tax. Filing your return ensures you fulfill your tax obligations and can help you avoid any potential penalties.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.