Loading

Get Ar Ar4ec 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR AR4EC online

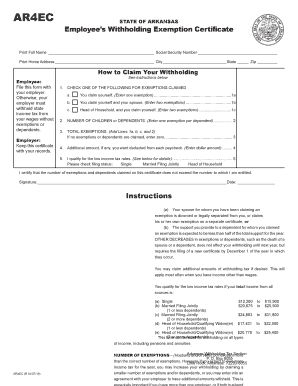

The AR AR4EC is an employee's withholding exemption certificate used in Arkansas. Properly filling out this form helps ensure that state income tax is withheld accurately based on your exemptions and dependents.

Follow the steps to complete the AR AR4EC online

- Click ‘Get Form’ button to access the AR AR4EC and open it in your preferred digital editor.

- Begin by entering your full name in the designated field followed by your social security number. Make sure the information is accurate to avoid issues with tax calculations.

- Next, fill in your home address, including city, state, and zip code. This information is necessary for your employer's records.

- Claim your exemptions by checking one option from the exemption section. Choose from claiming yourself, claiming yourself and a partner, or indicating head of household status.

- If applicable, enter the number of children or dependents you are claiming in the appropriate box. Remember, each dependent counts as one exemption.

- Calculate your total exemptions by adding the selections made in the previous steps. If you are not claiming any exemptions or dependents, write zero.

- If you wish to have additional amounts deducted from each paycheck, specify the desired dollar amount in the given field.

- Indicate your eligibility for low income tax rates by checking 'Yes' or 'No' based on the provided income thresholds.

- Finally, certify your information by signing the form and entering the date. This confirms that your claims are accurate.

- Once completed, you may save the changes, download, print, or share the form as needed.

Complete your AR AR4EC form online today to ensure your withholding is accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file an exempt in Arkansas, you need to fill out the AR4EC form accurately and submit it to your employer. Make sure to check the requirements surrounding your eligibility and ensure that you meet all necessary criteria. Using platforms like US Legal Forms can help streamline this process and ensure adherence to legal requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.