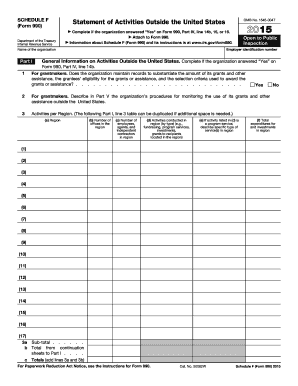

Get Irs 990 - Schedule F 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule F online

How to fill out and sign IRS 990 - Schedule F online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked to document management and legal processes, completing IRS forms can be profoundly anxiety-inducing. We recognize the importance of accurately finalizing documents.

Our platform offers a method to simplify the process of filling out IRS forms as effortlessly as possible. Follow this guide to swiftly and precisely complete IRS 990 - Schedule F.

Using our platform can undoubtedly facilitate professional completion of IRS 990 - Schedule F. We will ensure everything is in place for your ease and efficiency.

- Click on the button Get Form to access it and begin editing.

- Fill in all required fields in the chosen document using our sophisticated PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the entered information.

- Add the completion date for IRS 990 - Schedule F. Utilize the Sign Tool to create a unique signature for document validation.

- Conclude your edits by clicking on Done.

- Transmit this document directly to the IRS in the most suitable way for you: via email, virtual fax, or postal mail.

- You can print it out on paper when a physical copy is necessary and download or save it to your preferred cloud storage.

How to Alter Get IRS 990 - Schedule F 2015: Customize Forms Online

Completing documents is effortless with intelligent online tools. Remove paperwork with easily downloadable Get IRS 990 - Schedule F 2015 templates that you can adjust online and print.

Drafting papers and documents should be more attainable, regardless of whether it is a daily aspect of one’s profession or infrequent tasks. When one needs to submit a Get IRS 990 - Schedule F 2015, understanding regulations and guidelines on how to properly fill out a form and what it must contain can demand significant time and energy. Nonetheless, if you discover the right Get IRS 990 - Schedule F 2015 template, finishing a document will no longer pose a difficulty with an intelligent editor accessible.

Uncover a broader range of features you can incorporate into your document workflow routine. There’s no necessity to print, fill, and annotate forms by hand. With a clever editing platform, all the necessary document processing capabilities will always be available. If you wish to enhance your work efficiency with Get IRS 990 - Schedule F 2015 forms, locate the template in the directory, select it, and find a more straightforward way to complete it.

Mitigate the likelihood of mistakes using the Initials and Date tools. You can also incorporate custom visual elements into the form. Use the Arrow, Line, and Draw tools to personalize the document. The more tools you are acquainted with, the easier it is to navigate Get IRS 990 - Schedule F 2015. Explore the solution that provides everything needed to locate and modify forms within a single tab of your browser and leave behind manual paperwork.

- If you need to insert text in any section of the form or add a text field, utilize the Text and Text field tools and extend the text in the form as much as necessary.

- Take advantage of the Highlight tool to emphasize the key points of the form.

- If you need to conceal or eliminate certain text segments, use the Blackout or Erase tools.

- Personalize the form by incorporating default graphic elements. Use the Circle, Check, and Cross tools to include these features in the forms, as necessary.

- For additional notes, use the Sticky note tool and place any number of notes on the forms page as needed.

- If the document requires your initials or date, the editor has tools for that as well.

Get form

IRS Schedule F is primarily used to report profit or loss from farming activities, allowing farmers to itemize their income and expenses. This IRS 990 - Schedule F serves as a vital tool for accurately documenting financial information related to farming, which can impact your tax liability. If you need to navigate these complexities, consider using platforms like USLegalForms for guidance on creating and filing the necessary forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.