Get Irs 990 - Schedule F 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule F online

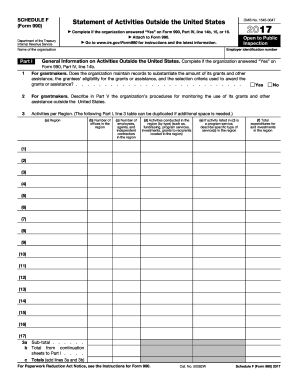

The IRS 990 - Schedule F is a crucial document for organizations operating outside the United States. It provides detailed information about activities, grants, and assistance. This guide aims to support users in successfully completing the form online, ensuring all necessary sections are filled accurately.

Follow the steps to complete the IRS 990 - Schedule F online.

- Click ‘Get Form’ button to download the IRS 990 - Schedule F and open it in your browser.

- Begin by filling in your organization’s details at the top of the form, including the employer identification number and the name of the organization.

- In Part I, if your organization answered ‘Yes’ on Form 990, Part IV, lines 14b, 15, or 16, respond to the first two questions regarding record maintenance and monitoring procedures.

- Next, complete the table under Activities per Region by providing information about each region where activities are conducted. Include the number of offices, employees, types of activities, and expenditures.

- Proceed to Part II to report grants and other assistance to organizations or entities outside the United States. Fill in the required information for each recipient that received more than $5,000.

- In Part III, list grants and other assistance provided to individuals outside the United States, detailing the type of assistance and amounts disbursed.

- Move to Part IV to respond to questions regarding foreign entities and partnerships, ensuring that compliance with additional filing requirements is addressed.

- Finally, use Part V to provide any supplemental information required by previous parts, including accounting methods and estimated numbers.

- After completing the form, review all entries for accuracy, then save changes, download a copy, print, or share the completed document as needed.

Ensure your organization's compliance by completing the IRS 990 - Schedule F online today.

Get form

Filling out Form 990 can be challenging due to its complexity, especially when additional schedules like the IRS 990 - Schedule F are required for international activities. However, using platforms like Uslegalforms simplifies the process, providing step-by-step guidance and ensuring all necessary information is included. With the right tools and resources, completing Form 990 becomes much more manageable.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.