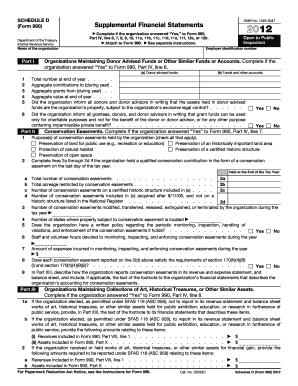

Get Irs 990 - Schedule D 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule D online

How to fill out and sign IRS 990 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you are not involved with document management and legal processes, completing IRS forms can be incredibly stressful. We understand the importance of accurately finishing documents.

Our online software provides a method to simplify the process of submitting IRS forms as much as possible. Follow these suggestions to accurately and swiftly complete IRS 990 - Schedule D.

Utilizing our service can definitely facilitate professional completion of IRS 990 - Schedule D. We will handle everything to ensure your work is comfortable and straightforward.

Click on the button Get Form to access it and commence editing.

Input all necessary fields in the document using our professional PDF editor. Activate the Wizard Tool to ease the process further.

Verify the accuracy of the information included.

Enter the date of completion for IRS 990 - Schedule D. Utilize the Sign Tool to create your unique signature for document validation.

Finish editing by selecting Done.

Transmit this document directly to the IRS in the method that suits you best: via e-mail, through digital fax, or postal mail.

You can print it on paper if a hard copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 990 - Schedule D 2012: tailor forms online

Select a dependable file modification service you can trust. Revise, finish, and authenticate Get IRS 990 - Schedule D 2012 securely online.

Frequently, dealing with documents like Get IRS 990 - Schedule D 2012 can prove difficult, particularly if you received them in a digital format but lack access to dedicated software. Certainly, alternative methods may exist to navigate around this issue, yet you risk creating a document that fails to meet submission standards. Utilizing a printer and scanner is not a viable solution either, as it consumes time and resources.

We provide a more straightforward and efficient method for completing documents. A comprehensive collection of document templates that are easy to personalize and certify, making them fillable for others. Our service goes far beyond merely offering a set of templates. One of the most advantageous aspects of using our service is that you can modify Get IRS 990 - Schedule D 2012 directly on our platform.

Since it is an online solution, it spares you from needing to acquire any computer software. Moreover, not all corporate policies allow for its installation on your company’s computer. Here’s the best approach to easily and securely finalize your paperwork with our platform.

Put aside paper and other ineffective strategies to modify your Get IRS 990 - Schedule D 2012 or other documents. Opt for our tool instead, which boasts one of the most extensive libraries of ready-to-personalize templates and a powerful file editing option. It's simple and secure, and can save you considerable time! Don’t just take our word for it, experience it yourself!

- Click the Get Form > you’ll be promptly directed to our editor.

- Once opened, you can initiate the customization process.

- Select checkmark or circle, line, arrow, and cross among other options to annotate your form.

- Choose the date option to insert a specific date into your document.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to insert fillable {fields.

- Select Sign from the top toolbar to create and append your legally-binding signature.

- Press DONE and save, print, and share or obtain the finished {file.

Get form

Unrealized gains and losses are typically not reported on your annual tax return. Instead, they are noted in the IRS 990 - Schedule D to provide an overview of your organization’s financial health. Monitoring these gains and losses is essential, as they can affect your organization’s net asset value and future tax liabilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.