Loading

Get Irs 990 - Schedule D 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule D online

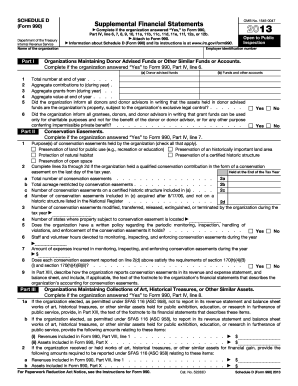

Filling out the IRS 990 - Schedule D is a vital part of ensuring compliance for tax-exempt organizations. This guide provides a step-by-step approach to help users navigate through the components of the form effectively and accurately.

Follow the steps to successfully complete the IRS 990 - Schedule D online.

- Click ‘Get Form’ button to access the IRS 990 - Schedule D form and open it in your preferred online editor.

- Begin by completing Part I: Supplemental Financial Statements. This section must be filled out if the organization answered 'Yes' to specific questions on Form 990, Part IV. Provide required information regarding donor advised funds and other similar accounts.

- Move to Part II: Conservation Easements. If your organization answered 'Yes' to Form 990, Part IV, line 7, classify the purposes of conservation easements held and provide details such as the total number of easements and their respective acreage.

- Proceed to Part III: Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets. Answer the questions regarding the organization’s holdings and provide a description if applicable.

- In Part IV, fill out information regarding escrow and custodial arrangements if applicable. Describe any arrangements where the organization acts as an agent or custodian for contributions not reported on Form 990.

- Complete Part V: Endowment Funds if necessary. Provide details of endowment funds held, including balances, contributions, and any related organizations.

- In Part VI, describe land, buildings, and equipment by providing costs, accumulated depreciation, and book values.

- Continue to fill out Parts VII to IX regarding investments and other assets, ensuring all financial descriptions and book values are accurate.

- In Part X, provide details for other liabilities and ensure that the amounts correspond with Form 990.

- Complete Parts XI and XII by reconciling revenue and expenses per audited financial statements with the amounts reported on the return.

- Finally, provide any supplemental information required in Part XIII to complete the form. Ensure that any necessary descriptions and footnotes are included.

- Review all completed fields for accuracy and completeness. Save your changes, download, print, or share the form as needed.

Complete your IRS 990 - Schedule D online today to ensure your compliance and reporting needs are met.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the IRS Form 990 is publicly available, allowing anyone to view nonprofit financial data. This transparency promotes trust and accountability within the nonprofit sector. If you are looking for a specific IRS 990 - Schedule D, use online resources or platforms such as US Legal Forms, which can guide you to the right documents effortlessly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.