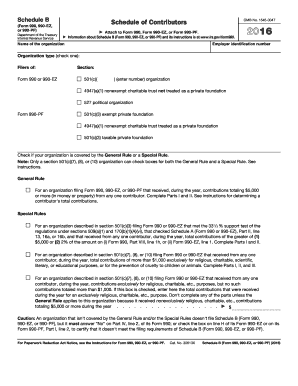

Get Irs 990 - Schedule B 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule B online

How to fill out and sign IRS 990 - Schedule B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked to document handling and legal affairs, completing IRS paperwork can be unexpectedly tiresome. We recognize the significance of accurately filling out forms.

Our system offers the functionality to simplify the process of submitting IRS documents to the greatest extent.

Using our comprehensive solution can indeed facilitate the professional completion of IRS 990 - Schedule B. We will do everything to ensure your work is comfortable and straightforward.

- Select the button Get Form to access it and begin editing.

- Complete all necessary fields in your document using our advanced PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the entered information.

- Include the date of submitting IRS 990 - Schedule B. Utilize the Sign Tool to create a distinctive signature for the document's validation.

- Conclude editing by clicking Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, using virtual fax, or postal service.

- It is possible to print it out if a hard copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 990 - Schedule B 2016: tailor forms online

Streamline your documentation preparation process and adapt it to your specifications with just a few clicks. Complete and authorize Get IRS 990 - Schedule B 2016 using a robust yet user-friendly online editor.

Handling documentation is consistently challenging, especially when you address it sporadically. It requires you to meticulously adhere to all protocols and accurately fill all sections with complete and correct information. Nevertheless, it frequently occurs that you need to revise the document or add additional sections to complete. If you aim to enhance Get IRS 990 - Schedule B 2016 before submission, the most efficient method to achieve this is by utilizing our powerful yet straightforward online editing tools.

This comprehensive PDF editing tool enables you to effortlessly and swiftly complete legal documents from any internet-enabled device, perform minor edits to the template, and incorporate additional fillable fields. The service permits you to designate a specific area for every type of information, such as Name, Signature, Currency, and SSN, etc. You can make them obligatory or conditional and select who should complete each field by assigning them to a designated respondent.

Follow the steps detailed below to enhance your Get IRS 990 - Schedule B 2016 online:

Our editor is a multifaceted online solution that can assist you in effortlessly and rapidly customizing Get IRS 990 - Schedule B 2016 and other forms according to your preferences. Decrease document preparation and submission duration and ensure your paperwork appears professional without complications.

- Access the required file from the directory.

- Complete the gaps with Text and drag Check and Cross tools to the checkboxes.

- Use the right-side toolbar to modify the template with new fillable sections.

- Select the fields based on the type of information you wish to gather.

- Designate these fields as mandatory, optional, or conditional and personalize their sequence.

- Allocate each field to a specific individual using the Add Signer feature.

- Verify that you’ve made all necessary adjustments and click Done.

Get form

Grants typically do not need to be reported on Schedule B unless they are classified as significant contributions. Schedule B of the IRS 990 highlights individual contributions from donors, while grants may be detailed in other sections of the form. Therefore, distinguish between donations and grants to ensure proper reporting. Clarity in your financial statements can help stakeholders understand your funding landscape better.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.