Loading

Get Irs 982 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 982 online

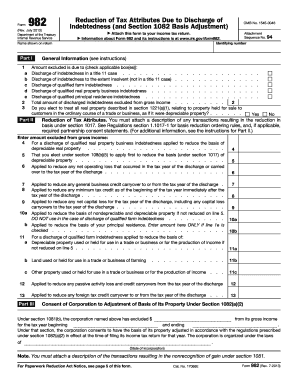

Form 982 is used to report the reduction of tax attributes due to the discharge of indebtedness, enabling certain borrowers to exclude amounts from their gross income. This guide provides clear instructions for completing the form online, ensuring users can navigate the process with confidence.

Follow the steps to complete your IRS 982 form online.

- Click the ‘Get Form’ button to obtain the form and access it for editing.

- Review the general information section to understand the purpose of the form. Indicate the type of discharge relevant to your situation by checking the appropriate box(es) for sections 1a to 1e.

- In Part I, line 2, record the total amount of discharged indebtedness you intend to exclude from your gross income.

- Proceed to Part II and complete lines 5 through 13 as applicable, reporting reductions in your tax attributes. Follow the prescribed order for each type of discharge by referencing the specific instructions for these lines.

- If applicable, complete Part III regarding the consent to adjustment of the basis for property under section 1082(a)(2). Ensure all details about transactions resulting in basis adjustments are documented.

- Review your entries for accuracy. Once satisfied, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out your IRS 982 form online today to ensure accurate and timely reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, TurboTax does support IRS Form 982, allowing you to easily report cancellations of debt when filing your taxes. The software guides you through the process, ensuring you can leverage any potential exclusions for cancelled debts. This makes your tax preparation simpler, especially when dealing with the implications of cancellation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.