Loading

Get Irs 9465-fs Instructions 2011-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 9465-FS Instructions online

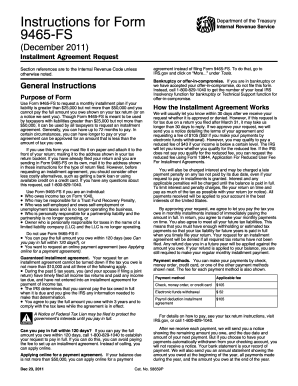

Filling out the IRS 9465-FS Instructions can be vital for taxpayers seeking a monthly installment plan. This guide will provide a clear, step-by-step approach to ensure the form is filled out correctly and submitted without complications.

Follow the steps to complete the IRS 9465-FS Instructions online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, if filing jointly, provide the names and social security numbers (SSNs) in the order shown on your tax return.

- If applying for a business tax liability, enter the business name and employer identification number.

- Enter the total amount you owe, as indicated on your tax return or notice. If this amount exceeds $25,000 but is less than $50,000, proceed to Part II.

- If you wish to agree to a Direct Debit Installment Agreement, indicate this on the form; otherwise, you must complete Form 433-F.

- On line 9, specify the amount you can pay each month, aiming for the highest amount possible to minimize penalties and interest.

- Choose the day of the month your payments will be due, selecting a date from the 1st through 28th.

- If your balance is over $25,000 but not more than $50,000, fill in lines 11a and 11b for electronic funds withdrawal, ensuring to check with your bank for accurate routing and account numbers.

- Once you have filled out all applicable fields, double-check your entries for accuracy.

- Save your changes, and proceed to download, print, or share the form as necessary. Remember to mail it to the appropriate IRS address based on your location.

Complete your IRS forms online to ensure accuracy and timely submission.

Related links form

When writing a check for an IRS payment, include “U.S. Treasury” in the payee line. It is also advisable to record your Social Security Number, the tax year, and the form number related to the payment in the memo section. Following the IRS 9465-FS Instructions can guide you in completing your payment correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.