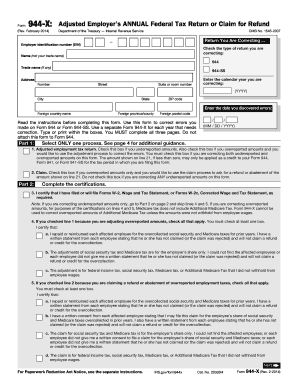

Get Irs 944-x 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 944-X online

How to fill out and sign IRS 944-X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document organization and legal procedures, submitting IRS documents can be incredibly overwhelming. We recognize the importance of accurately completing forms.

Our platform offers the answer to simplify the process of filing IRS forms to be as effortless as possible. Follow these guidelines to swiftly and correctly complete IRS 944-X.

Utilizing our service will enable professional completion of IRS 944-X. Make everything conducive for your efficient and swift workflow.

Click on the button Get Form to access it and begin editing.

Complete all mandatory fields in your document with our user-friendly PDF editor. Activate the Wizard Tool to make the process much simpler.

Ensure the accuracy of the information provided.

Include the submission date for IRS 944-X. Use the Sign Tool to create your unique signature for the document validation.

Conclude editing by clicking on Done.

Send this document directly to the IRS in the most convenient way for you: via email, using digital fax, or postal service.

You can print it out if a physical copy is required and download or save it to your preferred cloud storage.

How to Modify Get IRS 944-X 2014: Personalize Documents Online

Your swiftly modifiable and customizable Get IRS 944-X 2014 template is readily accessible. Utilize our assortment with an integrated online editor.

Are you delaying the preparation of Get IRS 944-X 2014 because you simply lack guidance on where to start and how to continue? We empathize with your situation and offer a fantastic tool for you that has nothing to do with overcoming your delays!

Our online collection of pre-designed templates enables you to browse through and select from countless fillable documents suited for diverse applications and situations. However, obtaining the file is merely the beginning. We equip you with all the essential instruments to finalize, sign, and modify the document of your preference without leaving our site.

All you have to do is access the document in the editor. Review the wording of Get IRS 944-X 2014 and verify whether it meets your expectations. Begin completing the document by taking advantage of the annotation tools to give your document a more organized and cleaner appearance.

In conclusion, alongside Get IRS 944-X 2014, you will receive:

With our professional solution, your finalized documents are typically officially binding and fully encrypted. We ensure the protection of your most sensitive information.

Acquire all that is needed to create a professional-grade Get IRS 944-X 2014. Make a wise decision and explore our foundation now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the document is meant for additional individuals, you can incorporate fillable fields and share them for others to complete.

- Once you finish completing the template, you can download the file in any available format or choose from any sharing or delivery methods.

- A comprehensive suite of editing and annotation tools.

- An included legally-binding eSignature solution.

- The capability to create documents from scratch or based on a pre-uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for protecting your files.

- A variety of delivery methods for simpler sharing and dispatch of documents.

- Adherence to eSignature regulations governing the use of eSignature in online processes.

Get form

Related links form

To determine if your employment tax liability will be $1,000 or less, evaluate your total payroll for the year. If your annual payroll for social security and Medicare taxes is under this threshold, you qualify for Form 944. Keeping track of your payroll and tax contributions can prevent misunderstandings when filing. Utilizing resources like USLegalForms can help clarify these calculations and ensure accuracy.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.