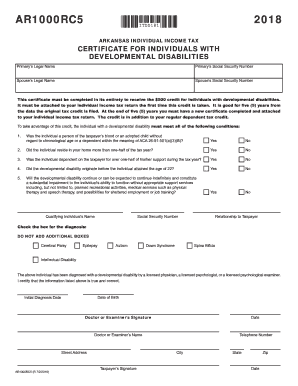

Get Ar Ar1000rc5 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AR AR1000RC5 online

How to fill out and sign AR AR1000RC5 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax time commenced unexpectedly or you simply overlooked it, it could likely create issues for you. AR AR1000RC5 is not the simplest option, but there is no cause for alarm in any case.

By utilizing our user-friendly solution, you will discover the optimal way to complete AR AR1000RC5 even in situations of urgent time constraints. All you need to do is adhere to these straightforward instructions:

Employing our robust digital solution and its beneficial tools makes completing AR AR1000RC5 more convenient. Do not hesitate to utilize it and allocate more time to leisure activities instead of preparing documents.

Launch the document with our expert PDF editor.

Input the necessary details in AR AR1000RC5, utilizing the fillable fields.

Add images, checkmarks, tick boxes, and text boxes, if required.

Repeated data will be filled in automatically after the initial entry.

If you encounter any challenges, refer to the Wizard Tool. You will find helpful suggestions for easier completion.

Remember to include the filing date.

Create your distinct e-signature once and position it in the necessary locations.

Verify the information you have entered. Correct any errors if needed.

Click on Done to finish editing and choose how you intend to submit it. You will have the option to use digital fax, USPS, or e-mail.

You can download the document to print it later or upload it to cloud storage options like Google Drive, OneDrive, etc.

How to adjust Get AR AR1000RC5 2018: personalize forms online

Utilize our robust online document editor to its fullest while organizing your paperwork. Complete the Get AR AR1000RC5 2018, highlight the key details, and effortlessly make any additional necessary adjustments to its content.

Filling out documents electronically is not only efficient but also allows you to modify the template to fit your needs. If you’re preparing to work on Get AR AR1000RC5 2018, think about completing it with our extensive online editing tools. Whether you make a mistake or input the required information in the incorrect section, you can swiftly modify the form without having to restart it from scratch like with manual entry. Additionally, you can emphasize the essential data in your document by highlighting specific sections with colors, underlining them, or encircling them.

Follow these straightforward and fast steps to complete and alter your Get AR AR1000RC5 2018 online:

Our powerful online solutions represent the most efficient way to fill out and amend Get AR AR1000RC5 2018 tailored to your preferences. Use it to manage personal or business documents from anywhere. Access it in a browser, make any amendments in your forms, and revisit them at any time in the future - all will be securely stored in the cloud.

- Open the document in the editor.

- Input the necessary information in the blank fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don't overlook any essential sections in the template.

- Circle some of the vital details and add a URL to it if required.

- Utilize the Highlight or Line tools to emphasize the most significant facts.

- Choose colors and thickness for these lines to ensure your sample appears professional.

- Delete or obscure the information you wish to remain hidden from others.

- Replace sections with errors and input the text that you require.

- Conclude editing with the Done button once you’ve verified everything is accurate in the document.

Get form

To file a CT-1120, which is used for corporate income tax in Connecticut, you will need to complete the form with your corporation’s financial details. Make sure to include any supporting documents that validate your income and deductions. Consulting resources or platforms like uslegalforms can simplify this process and guide you on specifics.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.