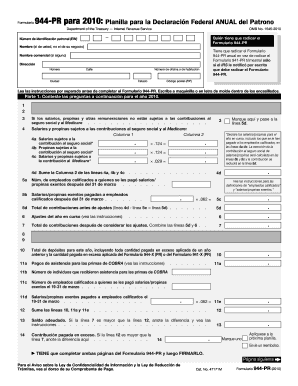

Get Irs 944-pr 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 944-PR online

How to fill out and sign IRS 944-PR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you are not linked with document organization and legal protocols, submitting IRS paperwork can be quite overwhelming.

We fully understand the importance of accurately completing documents.

Using our ultimate solution will enable efficient completion of IRS 944-PR. We will do everything to ensure your work is comfortable and swift.

- Click the button Obtain Form to access it and start editing.

- Fill in all necessary fields in your document using our beneficial PDF editor. Activate the Wizard Tool to make the process significantly simpler.

- Verify the accuracy of entered data.

- Enter the date of completing IRS 944-PR. Utilize the Sign Tool to create your unique signature for the document authentication.

- Conclude editing by selecting Finished.

- Send this file directly to the IRS in the most convenient manner for you: through email, with online fax, or through mail.

- You can print it out on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 944-PR 2010: personalize forms online

Put the appropriate document management tools at your disposal. Complete Get IRS 944-PR 2010 with our reliable solution that includes editing and eSignature capabilities.

If you plan to execute and sign Get IRS 944-PR 2010 online effortlessly, then our web-based option is the ideal choice. We offer an extensive template-based selection of ready-to-use documents that you can edit and fill out online. Additionally, you don’t have to print the document or rely on third-party services to make it fillable. All the necessary features will be easily accessible as soon as you launch the document in the editor.

Let’s explore our online modification tools and their primary features. The editor has a user-friendly interface, so it won’t take long to understand how to operate it. We’ll review three key sections that allow you to:

Beyond the features mentioned above, you can secure your document with a password, include a watermark, convert the file to the desired format, and much more.

Our editor simplifies completing and certifying the Get IRS 944-PR 2010. It allows you to handle virtually everything related to documents. Moreover, we consistently ensure that your experience in modifying files is secure and compliant with significant regulatory standards. All these factors enhance the enjoyment of using our tool.

Obtain Get IRS 944-PR 2010, make the necessary revisions and adjustments, and download it in your preferred file format. Give it a try today!

- Edit and comment on the template

- The top toolbar contains the features that assist you in highlighting and blacking out text, without images and visual elements (lines, arrows, and checkmarks, etc.), signing, initializing, dating the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the document or delete pages.

- Make them shareable

- If you want to make the template editable for others and share it, you can utilize the tools on the right to add various fillable fields, signatures, dates, text boxes, etc.

Get form

Related links form

Certain employers cannot use IRS Form 944, including those with an annual employment tax liability exceeding $1,000. Employers who are part of an employment tax program requiring Form 941 reporting must file that instead. Additionally, if you have a history of filing forms incorrectly, this may also prohibit you from qualifying for Form 944.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.