Loading

Get Irs 941-x 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-X online

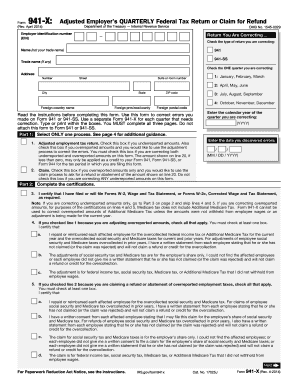

The IRS 941-X form allows users to correct errors made on Form 941 or 941-SS. This guide provides clear, step-by-step instructions for accurately completing the form online, ensuring that all necessary information is properly reported.

Follow the steps to successfully complete the IRS 941-X online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer identification number (EIN) at the top of the form, followed by your name and address details, ensuring accuracy for processing.

- Select the type of return you are correcting by checking the appropriate box for either Form 941 or Form 941-SS.

- Indicate the quarter you are correcting by checking the corresponding box (1 for January to March, 2 for April to June, 3 for July to September, or 4 for October to December).

- In Part 1, decide whether you will be making an adjustment or filing a claim. If correcting underreported amounts, check the box for adjustment; if for overreported amounts, choose claim.

- Complete Part 2 by certifying that you have filed Forms W-2 or W-2c as required, and check the applicable boxes to confirm your understanding related to the adjustments.

- In Part 3, enter the corrections for the quarter. Fill out Columns 1, 2, and 3 with the corrected amounts, originally reported amounts, and the differences respectively.

- Provide an explanation for your corrections in Part 4 if necessary. Specify if any corrections also involve reclassified workers.

- Finally, sign and date the form in Part 5. Make sure you have completed all three pages before submitting.

- After completing the form, save the changes and choose to download, print, or share the form as needed.

Complete your IRS 941-X form accurately online to ensure timely processing of your corrections.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 941 is used to report employment taxes, including federal income tax withheld and FICA taxes. Employers must file this form quarterly to show how much they have collected from employees and how much they owe to the IRS. It is essential for maintaining accurate tax records and ensuring compliance with payroll obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.