Loading

Get Nyc Dof Nyc-245 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF NYC-245 online

This guide provides comprehensive instructions on filling out the NYC DoF NYC-245 form online. It is designed to be user-friendly and accessible for individuals with varying levels of experience.

Follow the steps to accurately complete the NYC DoF NYC-245 form.

- Click 'Get Form' button to obtain the form and open it in the editor.

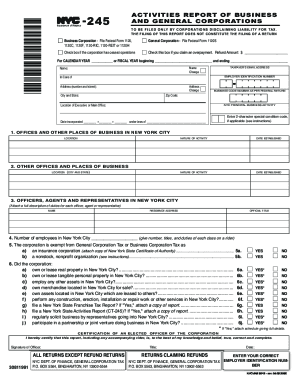

- Identify the type of corporation you are filing for by checking the appropriate box, indicating whether you are a Business Corporation or General Corporation.

- Provide the required details in the sections for taxpayer information, including name, email address, employer identification number, and business code number.

- Report the calendar or fiscal year during which the activities occurred by filling in the respective fields.

- List your offices and other places of business in New York City, detailing the location, nature of activity, and date established for each entry.

- Complete the section for officers, agents, and representatives, including their names, residence addresses, and official titles.

- Enter the number of employees in New York City and provide a rider with the titles and duties of each class.

- Indicate if your corporation is exempt from certain taxes by checking the appropriate boxes and providing required documentation, if necessary.

- Answer the questions regarding ownership or lease of property in New York City, and other business activities. Attach additional schedules as necessary.

- Certify the report by providing the signature of an elected officer of the corporation, along with their title and the date.

- Save the completed form. You may choose to download, print, or share the form as needed.

Complete your NYC DoF NYC-245 form online today to ensure compliance and accuracy.

Related links form

File Your Federal Tax Return If you're business is an S corporation, you'll file Form 1120S, a tax return that shows your corporation's income, expenses and losses. You'll also file a Form K-1 for each of your corporation's shareholders, showing their share of the corporation's income, deductions and credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.