Loading

Get Ma Dor 1 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

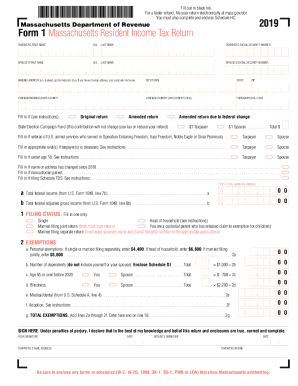

How to fill out the MA DoR 1 online

Filling out your Massachusetts DoR 1 form online can streamline the tax filing process and help ensure accuracy. This guide will walk you through each section of the form, providing clear and supportive instructions tailored for all users, regardless of their legal experience.

Follow the steps to complete your MA DoR 1 form online.

- Press the ‘Get Form’ button to access the Massachusetts DoR 1 form and open it in your online editor.

- Begin by entering the taxpayer’s first name, middle initial, and last name in the designated fields. Next, input the taxpayer's Social Security number in the space provided.

- Below the taxpayer information, enter the spouse’s first name, middle initial, last name, and Social Security number if applicable.

- Fill in the mailing address by providing the street number and name, apartment or suite number (if applicable), city or town, state, and ZIP code. For foreign addresses, complete the additional fields for province, postal code, and country.

- Select the appropriate box to indicate if you are filing an original return, an amended return, or an amended return due to a federal change.

- If applicable, contribute to the State Election Campaign Fund by filling in the contribution amount for the taxpayer and spouse.

- Indicate if the taxpayer or spouse is a veteran who served in specified operations by marking the corresponding checkbox.

- Check the relevant boxes if either the taxpayer or spouse is deceased, under the age of 18, or if there has been a change in name or address since the last filing.

- Fill in the personal exemptions total based on your filing status and the number of dependents, along with additional exemptions for age or blindness if applicable.

- Proceed to report income details as instructed in sections pertaining to wages, pensions, and other relevant income sources.

- Complete the deductions section by entering amounts for Social Security, Medicare payments, and any other allowable deductions.

- Calculate and fill out the total income tax, including any credits, and ensure all fields are accurately filled based on your financial information.

- Finally, review all entered information for accuracy. Users can save changes, download, print, or share the completed form.

Complete your MA DoR 1 form online to ensure a smooth filing process.

Generally, if you make $8,000 or more you'll need to file a Massachusetts tax return. ... Part-year residents who receive or accrue Massachusetts gross income in excess of $8,000 during the taxable year are required to file a Massachusetts income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.