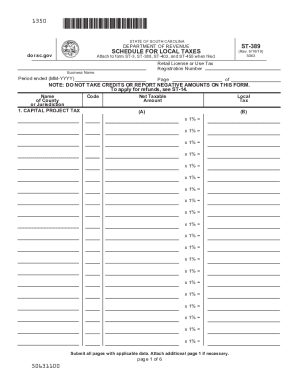

Get SC ST-389 2019

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Applicable online

How to fill out and sign Refunds online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax blank completion can become a significant obstacle and severe headache if no appropriate guidance supplied. US Legal Forms has been created as an online resolution for SC ST-389 e-filing and supplies many advantages for the taxpayers.

Make use of the tips about how to complete the SC ST-389:

-

Find the template online within the respective section or via the Search engine.

-

Press the orange button to open it and wait until it?s done.

-

Review the blank and pay attention to the recommendations. If you have never completed the sample before, stick to the line-to-line recommendations.

-

Concentrate on the yellow-colored fields. These are fillable and demand specific information to get inserted. In case you are uncertain what data to insert, see the recommendations.

-

Always sign the SC ST-389. Use the built-in instrument to make the e-signature.

-

Click on the date field to automatically place the appropriate date.

-

Re-read the template to press and change it ahead of the submission.

- Press the Done button in the top menu when you have finished it.

-

Save, download or export the accomplished template.

Utilize US Legal Forms to ensure comfortable and easy SC ST-389 filling out

How to edit Gov: customize forms online

Enjoy the user friendliness of the multi-featured online editor while completing your Gov. Make use of the diversity of tools to rapidly complete the blanks and provide the required information in no time.

Preparing documentation is time-consuming and expensive unless you have ready-to-use fillable forms and complete them electronically. The simplest way to cope with the Gov is to use our professional and multi-featured online editing solutions. We provide you with all the essential tools for fast document fill-out and enable you to make any edits to your templates, adapting them to any demands. Aside from that, you can comment on the updates and leave notes for other parties involved.

Here’s what you can do with your Gov in our editor:

- Fill out the blanks using Text, Cross, Check, Initials, Date, and Sign options.

- Highlight important details with a desired color or underline them.

- Hide confidential data with the Blackout option or simply erase them.

- Insert images to visualize your Gov.

- Substitute the original text with the one corresponding with your requirements.

- Leave comments or sticky notes to inform others about the updates.

- Drop extra fillable fields and assign them to particular recipients.

- Protect the template with watermarks, add dates, and bates numbers.

- Share the paperwork in various ways and save it on your device or the cloud in different formats once you finish adjusting.

Dealing with Gov in our powerful online editor is the fastest and most productive way to manage, submit, and share your documentation the way you need it from anywhere. The tool operates from the cloud so that you can access it from any place on any internet-connected device. All templates you generate or fill out are safely kept in the cloud, so you can always access them whenever needed and be confident of not losing them. Stop wasting time on manual document completion and get rid of papers; make it all on the web with minimum effort.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing exemptions

Learn how to fill in the jurisdictions to increase your efficiency. Useful tips will allow you to complete a template in a much faster way and optimize how you spend your time.

Locality FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to SC ST-389

- exempts

- taxable

- worksheet

- allowable

- exemptions

- jurisdictions

- locality

- municipality

- applicable

- SC

- Totals

- refunds

- gov

- exemption

- numerical

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.