Loading

Get La Ldr It-540bi 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

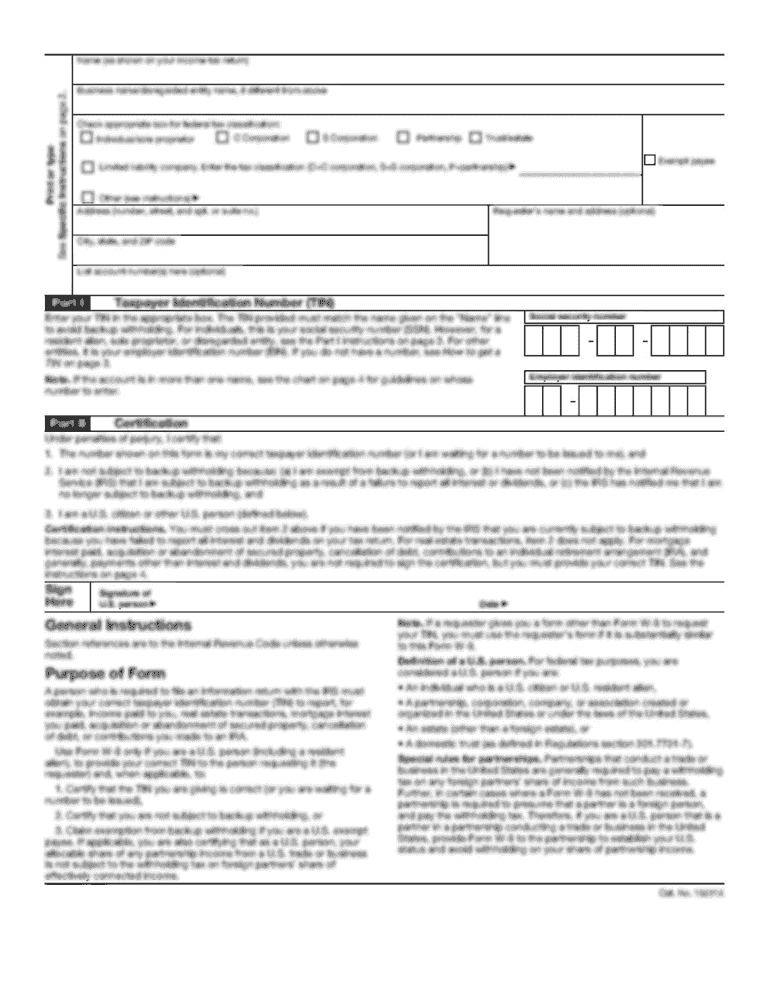

How to fill out the LA LDR IT-540Bi online

Filling out the LA LDR IT-540Bi form online can be a straightforward process if you follow the appropriate steps. This guide will provide comprehensive instructions to help you complete and submit your Louisiana Nonresident Individual Income Tax Return with confidence.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Use black ink only when filling out the form. Ensure that all entries are legible and align with the corresponding fields.

- Enter your legal name, address, Social Security Number, and date of birth at the required sections of the form. If there are any changes from last year, mark the appropriate boxes.

- Indicate your filing status by selecting the appropriate option on the form, ensuring it matches your federal return filing status.

- Complete the Nonresident and Part-Year Resident Worksheet to determine your Louisiana-sourced income, reporting all relevant figures in the designated sections.

- Fill in your Federal Adjusted Gross Income on the form, making sure to follow the worksheet instructions.

- Apply any available credits by referring to the appropriate schedules, such as Schedule C-NR, F-NR, and J-NR, and entering the details as needed.

- Review all entries for accuracy. If claiming refunds or credits, ensure that you have attached any necessary documentation.

- Save your changes and proceed to download or print your completed form for submission.

- Submit the form as instructed, either electronically or via mail as required, keeping a copy for your records.

Complete your Louisiana tax documents online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an extension request electronically via the Louisiana Department of Revenue's Individual Income Online Tax Filing application or the Online Extension Filing application; Filing an extension request electronically via LDR's IVR phone system by calling 225-922-3270 or 888-829-3071.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.