Get Il Dor Il-1120 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

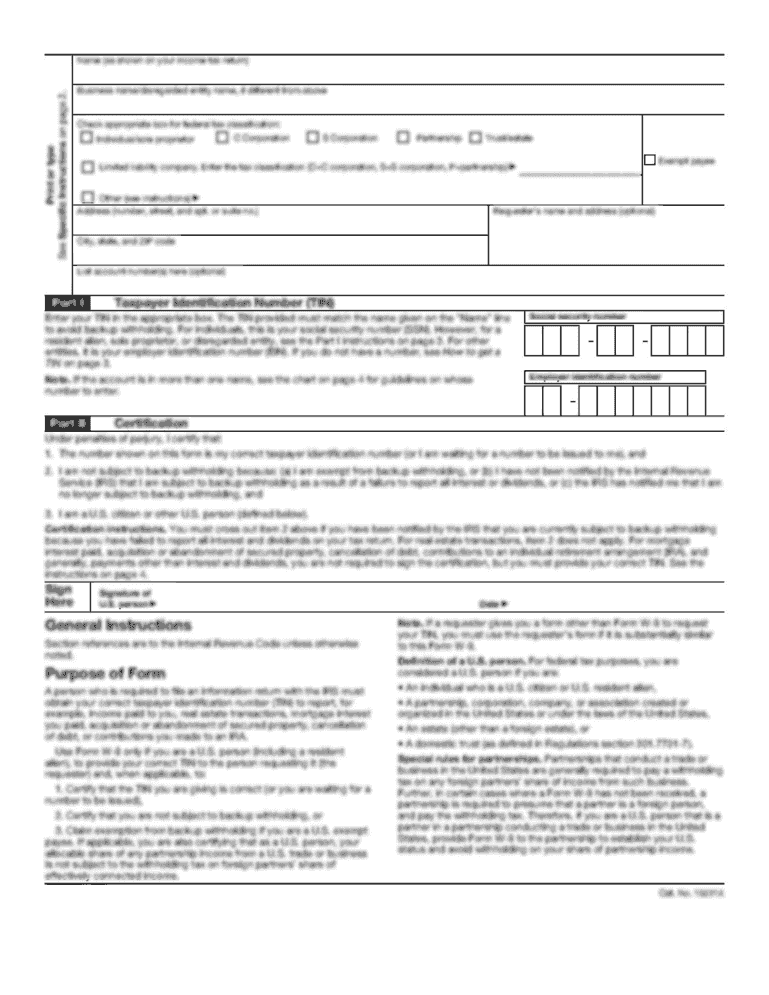

Tips on how to fill out, edit and sign IL DoR IL-1120 online

How to fill out and sign IL DoR IL-1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Confirming your earnings and declaring all the crucial taxation reports, including IL DoR IL-1120, is a US citizen?s exclusive responsibility. US Legal Forms tends to make your taxes managing more transparent and precise. You can get any lawful samples you require and complete them digitally.

How you can prepare IL DoR IL-1120 online:

-

Get IL DoR IL-1120 within your browser from your gadget.

-

Gain access to the fillable PDF file making a click.

-

Start completing the template box by box, following the prompts of the sophisticated PDF editor?s interface.

-

Accurately enter textual information and numbers.

-

Select the Date field to place the current day automatically or change it manually.

-

Apply Signature Wizard to make your custom e-signature and sign in seconds.

-

Use the Internal Revenue Service instructions if you still have any queries..

-

Click on Done to save the revisions..

-

Proceed to print the document out, download, or share it via E-mail, SMS, Fax, USPS without exiting your browser.

Keep your IL DoR IL-1120 securely. You should ensure that all your appropriate paperwork and data are in order while keeping in mind the time limits and taxation regulations established by the IRS. Do it simple with US Legal Forms!

How to edit IL DoR IL-1120: customize forms online

Put the right document management capabilities at your fingertips. Complete IL DoR IL-1120 with our trusted tool that combines editing and eSignature functionality}.

If you want to complete and sign IL DoR IL-1120 online without hassle, then our online cloud-based option is the ideal solution. We provide a rich template-based catalog of ready-to-use paperwork you can modify and complete online. Moreover, you don't need to print out the form or use third-party solutions to make it fillable. All the necessary tools will be available for your use as soon as you open the document in the editor.

Let’s go through our online editing capabilities and their main features. The editor has a self-explanatory interface, so it won't require much time to learn how to utilize it. We’ll take a look at three main sections that let you:

- Edit and annotate the template

- Arrange your documents

- Prepare them for sharing

The top toolbar has the tools that help you highlight and blackout text, without graphics and graphical factors (lines, arrows and checkmarks etc.), add your signature to, initialize, date the document, and more.

Use the toolbar on the left if you would like to re-order the document or/and delete pages.

If you want to make the document fillable for other people and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

Apart from the functionality mentioned above, you can shield your document with a password, add a watermark, convert the file to the needed format, and much more.

Our editor makes completing and certifying the IL DoR IL-1120 a breeze. It enables you to make virtually everything concerning dealing with documents. Moreover, we always make sure that your experience modifying documents is protected and compliant with the major regulatory criteria. All these factors make utilizing our solution even more enjoyable.

Get IL DoR IL-1120, apply the necessary edits and changes, and get it in the desired file format. Try it out today!

Get form

Form 1065 is used to first declare business partnership income to the IRS and then Schedule L is used to detail the specific of the partnership balance sheet. The balance sheet includes all business assets, equity, and capital, as well as liabilities and it provides a financial overview of the business.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.