Loading

Get Pa Birt-ez 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA BIRT-EZ online

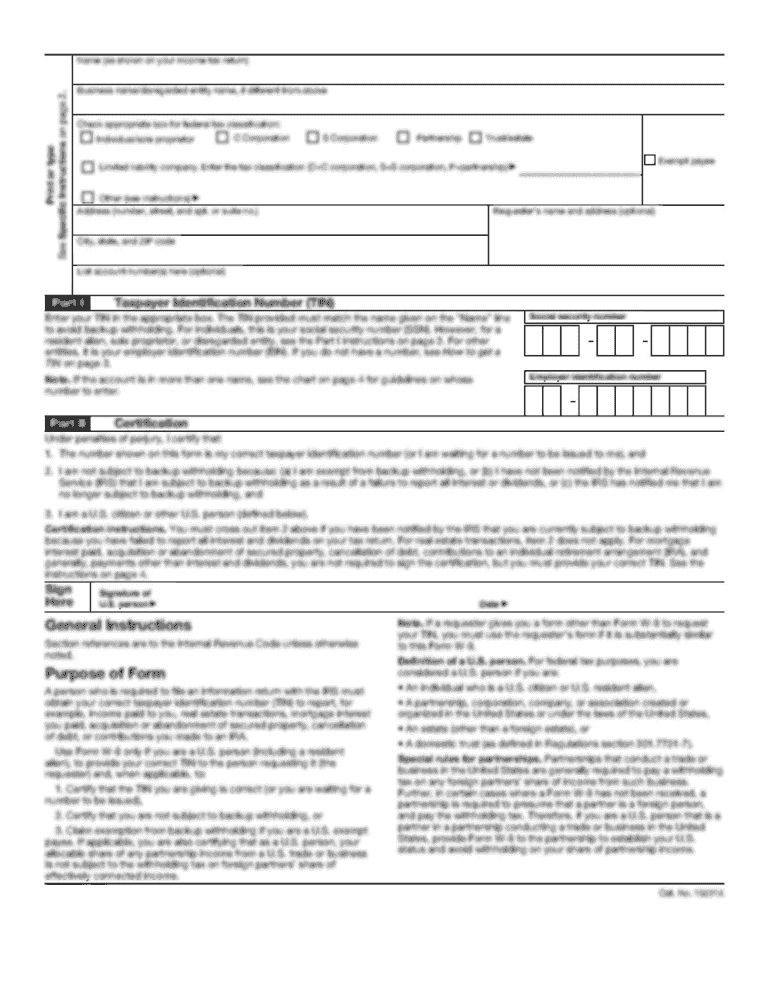

The PA BIRT-EZ is a simplified form for the Business Income and Receipts Tax designed for businesses operating 100% within Philadelphia. This guide provides detailed steps to help users efficiently complete the form online.

Follow the steps to fill out the PA BIRT-EZ online.

- Press the ‘Get Form’ button to obtain the form and open it in an available editor.

- Fill in the city account number associated with your business. This unique identifier is essential for processing your application.

- Enter the taxpayer name and address in the designated fields. Ensure accuracy to avoid issues with your submission.

- Provide the Employer Identification Number (EIN) or Social Security Number (SSN) as appropriate. This information is required for identification purposes.

- Input the taxpayer email address for any correspondence regarding your submission.

- If your business has changed its address, check the provided box to indicate this change.

- If the business terminated in 2019, enter the termination date and note that a change form must also be filed.

- You must complete Worksheet 'S-EZ'; this is essential for accurately calculating your tax liability.

- Indicate if this is an amended return by placing an 'X' in the designated box.

- Calculations begin by filling out the net income portion of tax as noted on Page 2, Line 6, and the gross receipts portion as noted on Page 2, Line 11.

- Add the net income tax and gross receipts tax to determine the total tax due for 2019. enter the date in the respective line.

- Revisit the estimated payments and other credits section to evaluate any payments made previously that may offset your tax due.

- Calculate the net tax due by subtracting total payments and credits from the total due.

- Refer to the provided instructions for the applicable interest and penalty, if any.

- Complete the signature fields to affirm accuracy and completeness of your submission.

- Finally, choose to save changes, download, print, or share the completed form as per your needs.

Encourage completing your documents online to ensure timely filing and ease of access.

Related links form

Out-of-state employers are not required to withhold Philadelphia's Wage Tax if they don't have a physical location within Pennsylvania or aren't subject to the Business Income and Receipts Tax. When no Wage Tax is withheld, Philadelphia residents must file and pay the Earnings Tax themselves. ... Net Profits Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.